The Kamran Afshar- Greater Lehigh Valley Chamber of Commerce survey of Lehigh Valley businesses is done on a quarterly basis and collects around a 1,000 observations per year. The Employment and Purchasing Index for the Lehigh Valley highlights the results of these surveys.

In April 2014 we conducted our 58th survey of this series, The following is a summary of our findings.

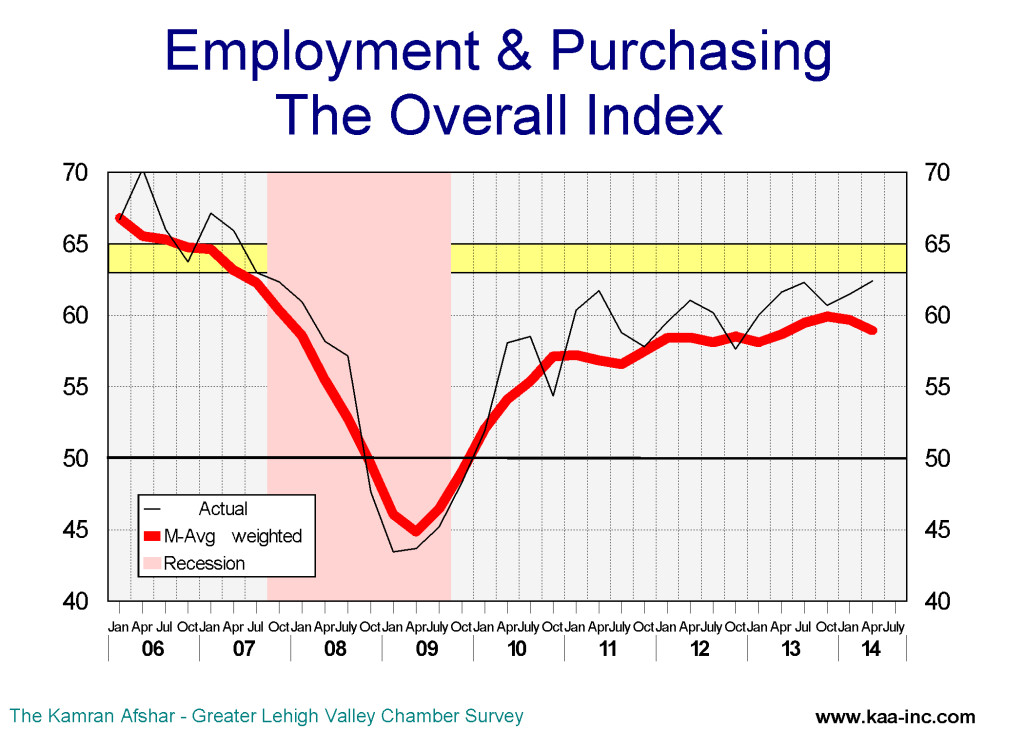

Business sentiment, as measured by the overall index dropped to 58.9 (seasonally adjusted weighted average, SAWA) in January 2014, a 4.6% drop from October 2013. However it is still 0.4% above the January 2013 level.

It should be noted that any index above 50 means more than half of the participants were positive about the economy.

Participants’ expectations of the future showed a slight decline while their assessment of the past recorded an equally slight increase in April. However, neither change is statistically significant. The moving average of the expectations of the future has show some decline, while the assessments of the past has remained more or less constant.

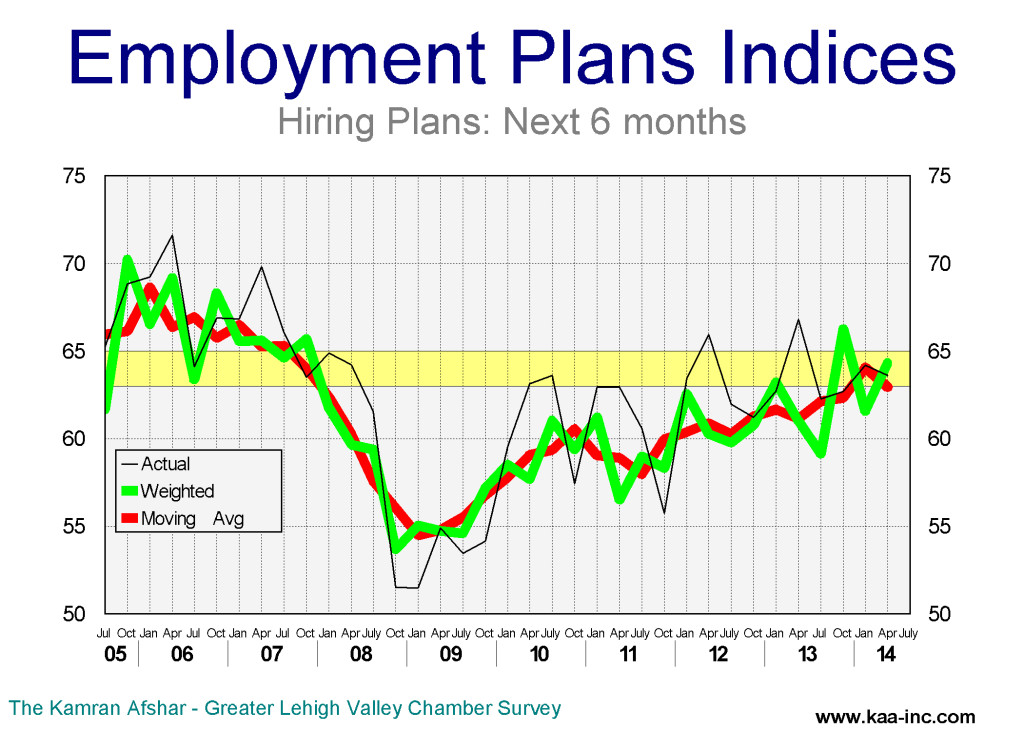

The largest gain in April was in the index of planned hiring for the next 6 months. This index was up 4.5% and 5.4% respectively as measured against January 2014 and April 2013.

The index of planned hiring for the next 6 months rose to 64.3 in April. For the second time in the last 6 months this index has reached this level, highest since October of 2007. This is also well inside the Valley’s expansion range of 63 to 65. Historically when this index has topped this range, the Valley has experienced a rapid employment growth in the following 6 months. And we are so very close to that threshold.

The average business participating in the survey is planning to hire 1.0 new employees in the next 6 months, an increase over January’s 0.7, however, still short of the October 2013 period when the plans were to hire 1.4 more people in the next 6 months. The more reliable index for forecasting employment over the next 6 months is the moving average of the index which is now running slightly below 1.0 which is a strong indicator for future employment.

The percentage of the companies which are planning to increase their employment in the next 6 months was 27.8, compared to 5.7% that are planning to reduce employment at their site. The percentage of companies with plans for net increase gain in employment in January was 22.1%, which is also a very strong indicator for future employment.

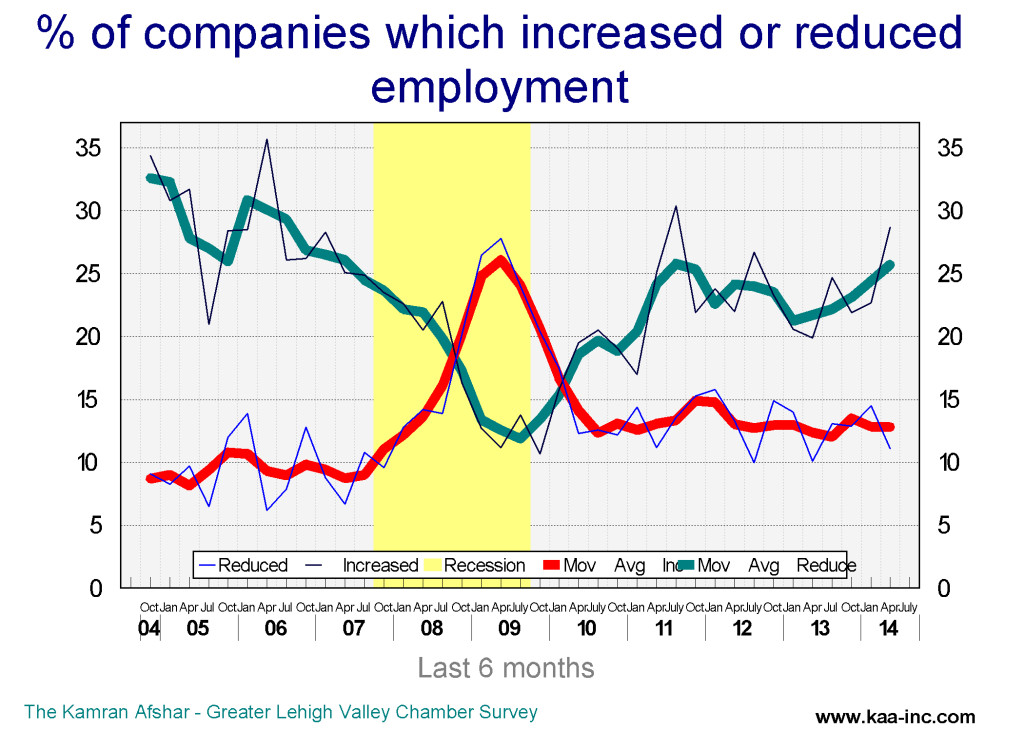

The index of actual hiring during the last 6 months also rose in April, leveling at 57.8 while only 1.9% above its January level, however, it stands at whopping 7.1% above its April 2013 level. This is the highest post recession level for this index. The average business participating in the survey hired 0.9 new employees in the last 6 months.

The percentage of the companies which increased their employment has been exceeding those who reduced theirs since April 2010. And in general, the percent of those increasing has risen more than those decreasing since the end of the recession.

Conversely, the percentage of those decreasing employment has gone down more than up during the same period.

In April 28.7% of the participants in our survey increased their employment while 11.1% reduced theirs. The percentage of companies with net gain in employment in October was 17.6%.

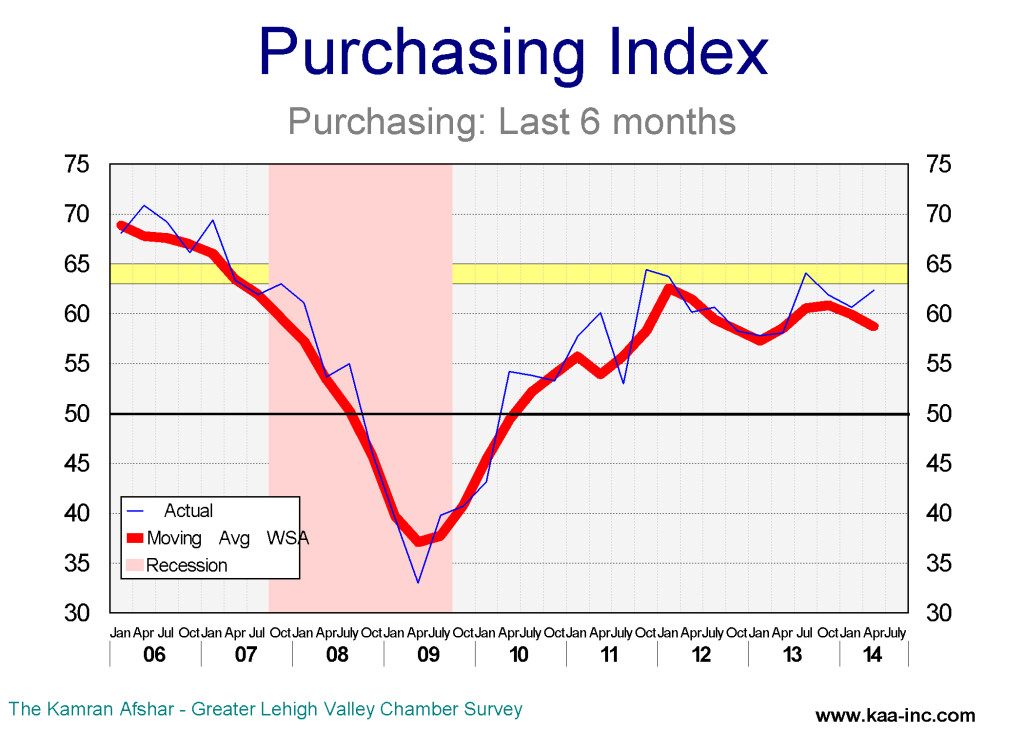

The index of actual purchases in the last 6 months represents “where the rubber meets the road.” An average company participating in our January 2014 survey reported a 1.8% increase in their expenditures in the last six months, a significant increase above January of 0.2%. The index for actual purchases in the last 6 months stood at 59.1 in April a slight increase over January’s 58.3 and a 2.7% increase over last April’s level.

The surprising index is the index of plans for future expenditures dropped sharply to 54.7 in April after and equally sharp drop in January. This index has dropped by 13.7% since October 2013. Considering all the other variables, this is odd. Particularly since the average participant in the survey upped their plans for increasing their expenditures to 3.5% in April from 1.1% in January. Even when this index was at its post recessionary high average in October 2013, average participant was planning to increase their expenditures by only 1.7%,

The issue appears to be the defusion index, while the overall index shows very slow increase in the percentage of the companies who are planning to expand in the next 6 months, those who are expanding are doing it at an increasing rate. Those businesses in the Valley who are expanding, are raising their rate of expansion, while others are very slowly joining the fast lane.

Based on the data over the last 12 month we expect the rate of growth of the economy in the Valley to grow, however, this is clearly not across the board and the distance between leaders and followers is widening and is expected to widen even further during 2014.