Does Anybody still remember what we used to call inflation, what happened to it?

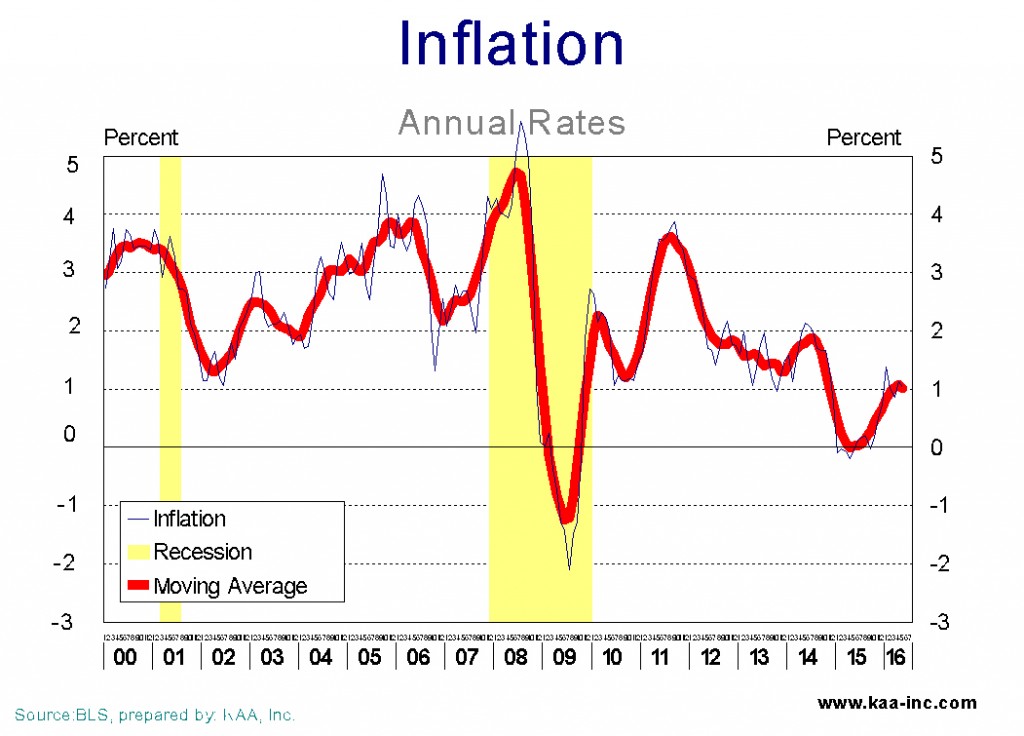

Before the Great Recession, inflation was rising at a pretty healthy rate, reaching as high as 5.6%, however, the recession wiped out that inflation alongside 8.7 million payroll jobs, a booming housing market, more than 500 commercial banks as well as thousands of other businesses.

!

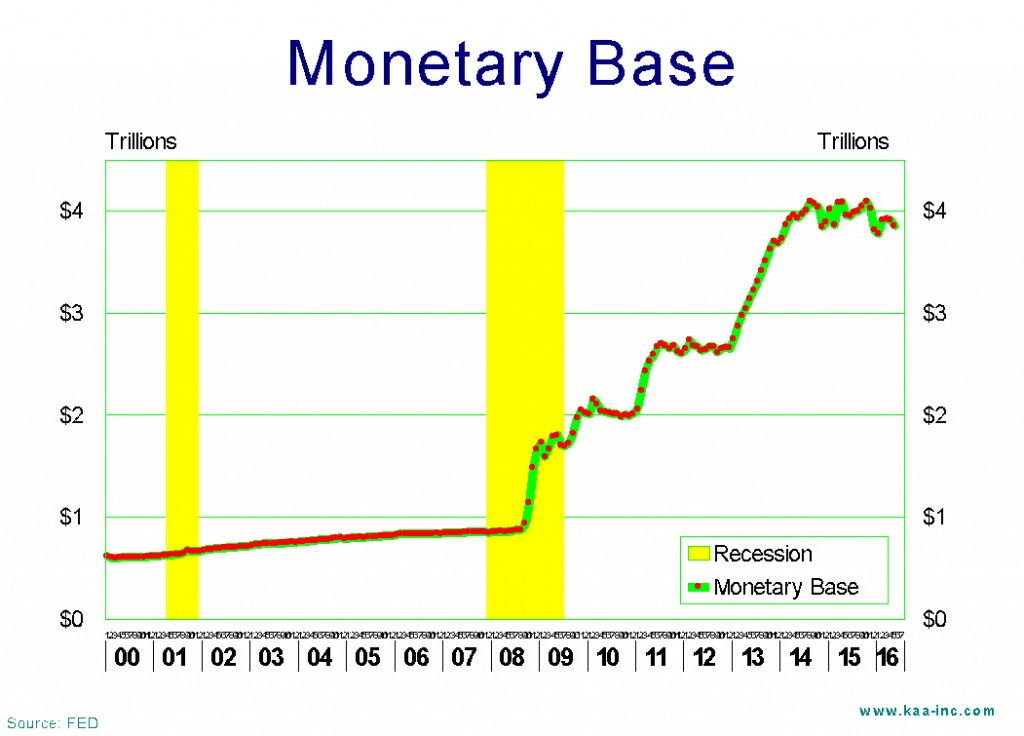

The FED was not all that active during the months leading to the Great Recession. They basically disregarded a number of alarms raised by relevant banking data. At the time the solution appeared to be changing the definition or down grading the importance of the indicators which raised alarms about the liquidity of the US banking system.

The FED eventually discovered that the alarms were for real and switching them off did not remove the problem, and to its credit, it then went to town on raising the money supply and helping many banks fend off bankruptcy. The FED continued pushing high powered money into the economy way after the official end of the recession; by the middle of 2014 the monetary base was almost 5 times its pre-recessionary level.

The rapid increase in the monetary base did ring all the inflation alarm bells, and this time round everybody paid attention, however, no inflation appeared. Many monetarists of the 1970s and 80s are turning in their graves, as they theorized, affirmed and predicted that large increases in the money supply, and by which they meant things like 20% or 30%, will be translated into hyperinflation in a relatively short period of time. And of course the German hyperinflation of the early 1920s was a clear proof of the concept. But inflation didn’t come! At 1.0% we are much closer to deflation than anything resembling what used to be called inflation.

What gives? The Great Recession does. The economy was so badly mauled and battered that the velocity of money (that is the rate of circulation of money) crashed, like many other things in the economy, and while a lot more money was being pushed into the system, since it was circulating at a slower and slower pace, it did not cause the expected inflation, and it appears that its is not going to do so anytime soon. On top of that, the crash of oil prices over the last couple of years which was accompanied with declines in the prices of many other raw materials have almost locked the inflation rate in low gear.

As the recovery started to move ahead faster and unemployment rate dropped we all expected the velocity of money to rise, as it did in every recovery until now. This time round it didn’t, actually velocity of money recorded a very small increase after the start of the recovery, and then it again started to decline, albeit at a much more orderly pace than before. And while there are a variety of explanation for the continuing decline in rate at which money circulates in the economy, including the wider use of electronic money, the fact is that the velocity of money is continuing to drop.

Despite of having no inflation, the FED is slowly reducing the monetary base, just in-case all of this discussion about the new normal is a fancy way for economists to say, we really don’t understand why inflation is this low!