Consumer sentiment rose sharply due to further increases in earnings

As of the last week of May 2016, gasoline prices were hovering around $2.35, still around 20% lower than their last year’s level at the same time, but clearly much higher than the $1.90s which was available back in February. And the DJIA is still above its last year’s close.

Both the gasoline prices and the stock market influence consumer sentiment and how consumers feel directly impacts the economy, considering that more than two-thirds of our economy is consumer expenditures.

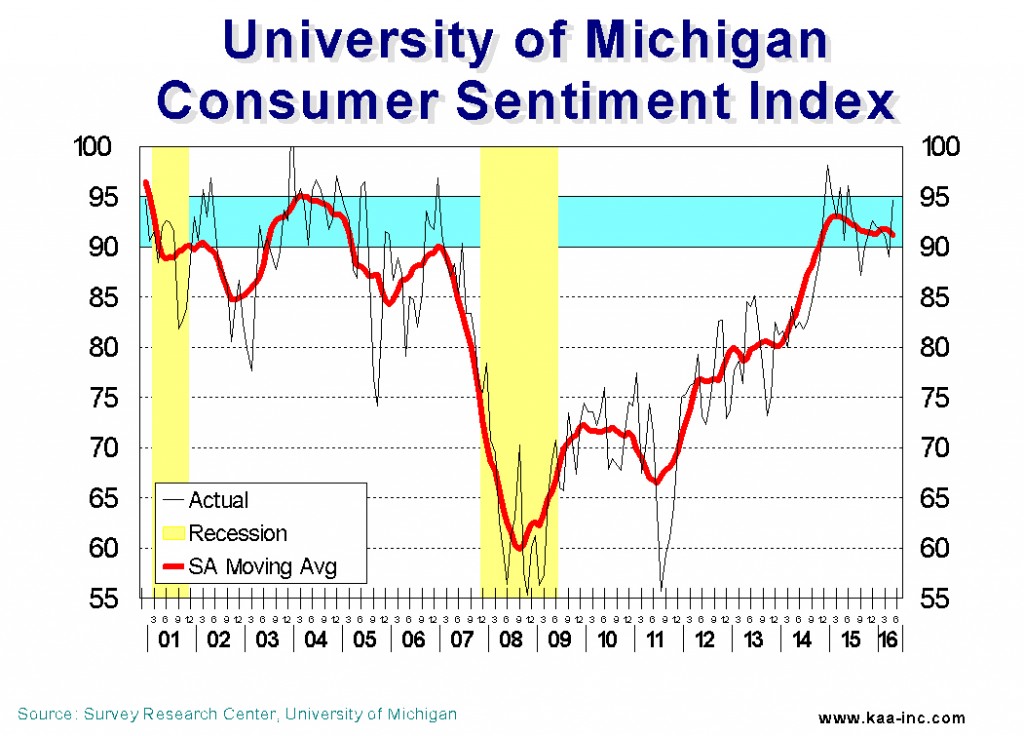

A brief look at the University of Michigan’s consumer sentiment index shows that it ran between 90 and 95 during the 2003-2004 prosperous economic period, then it started to dropped about a year before the start of the Great Recession. While the economy was still humming during the first 3 quarters of 2007, and the DJIA was rose by 12%, the consumer sentiment index dropped by 13.5 points, by the end of 2007, the index had plunged by 20%. During the recession the index further crashed all the way down to a low of 55.

Interestingly enough, some 6 months before the official end of the recession, consumer sentiment index started to climb. Rising to 68 by the official end of the recession.

Consumer sentiment index is clearly one of the strong leading indicators of the economic cycles.

The index rose sharply in May to 94.7, its second highest level in last 12 months. the long-range trend of the index has been well within the range that prevailed during the prosperous economic times of the past since the middle of 2014..

The sharp rise in the May’s consumer sentiment index was due to improving job market as well as higher income experienced by consumers. They also enjoyed the low interest and inflation environment as well as an improved job market outlook. While income gains were recorded across the board, the largest gains were among lower income and younger households. The May data recorded the highest share of households since 2000 who said their earnings had recently grown. And most interesting is consumers’ anticipation of gain in their home values during the year ahead which is at its highest level in almost a decade.

There is however, a growing sense of uncertainty, according to the University of Michigan’s survey, as to the shape of government’s economic policies under a new president. This will temper consumer spending