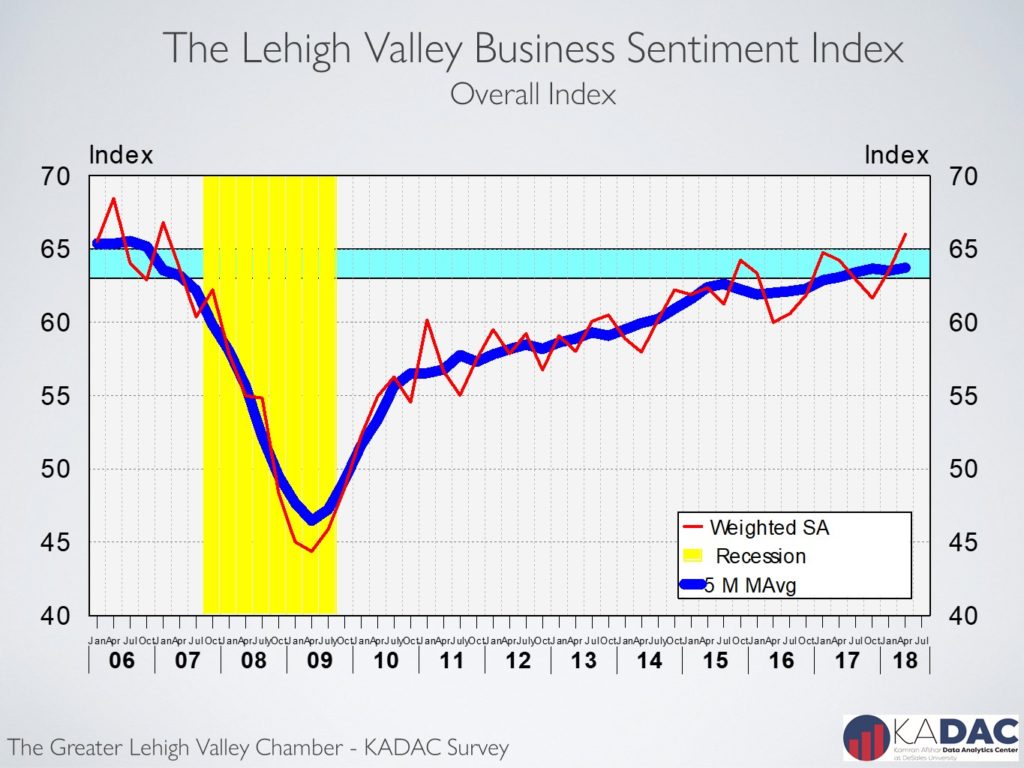

Lehigh Valley business sentiment highest since 2007

The Greater Lehigh Valley Chamber of Commerce -Kamran Afshar survey of the Valley businesses is a quarterly survey that has been conducted since 1998. In April 2018. The business sentiment index in the Valley rose to its highest level since 2007!

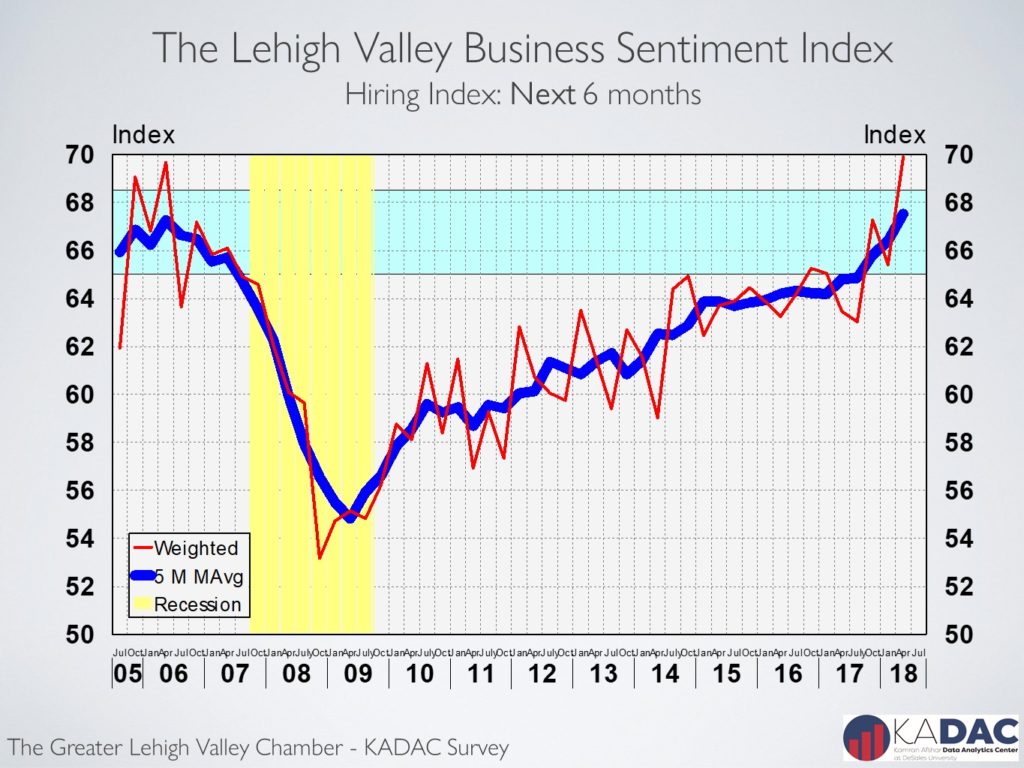

The index of hiring plans for the next 6 months with an increase of 6.9% over its January 2018 level recorded the largest increase among indicators in the model. Employment in the last 6 months also recorded a significant increase in the April survey. The purchasing indices, however, both showed small increases in 2018, while remaining below their April 2017 levels.

The index of hiring plans for the next 6 months spiked to 69.9 in April, its highest level since July of 1999! This index is now at the top of the range which is historically associated with rapid employment growth in the Valley.

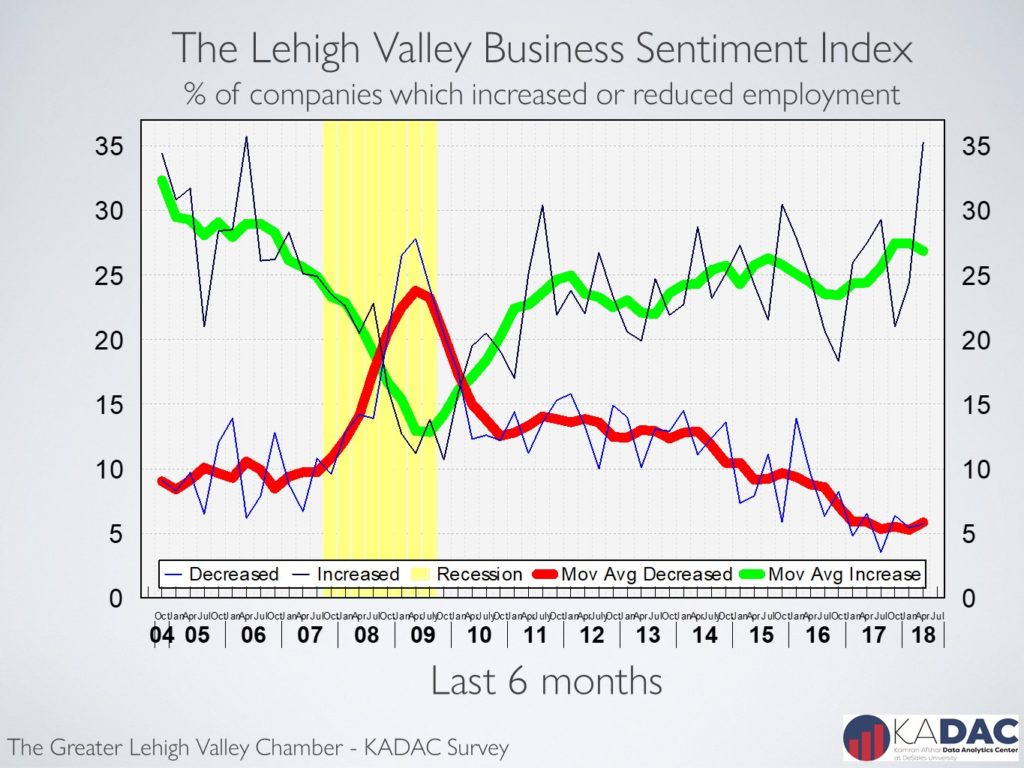

The index of actual hiring over the last 6 months also recorded a significant increase in April 2018, exceeding its April 2017 level by 7.1%. This index is also in range associated with rapid employment growth in the Valley.

Valley businesses participating in the survey have reduced their layoff rates to below their boom years level during 2004 through 2006. A data point which is directly supported by the decline in the number of initial unemployment claims which has now dropped to tight labor market level for the Valley.

The index for actual purchases over the last 6 months while increasing during the last two quarters, is still below its last year’s level and is trending flat. The rapid increase in purchasing during the first 2 quarters of last year appears to have been mostly due to post election enthusiasm. Many of the same businesses have cut back their rate of expansion.

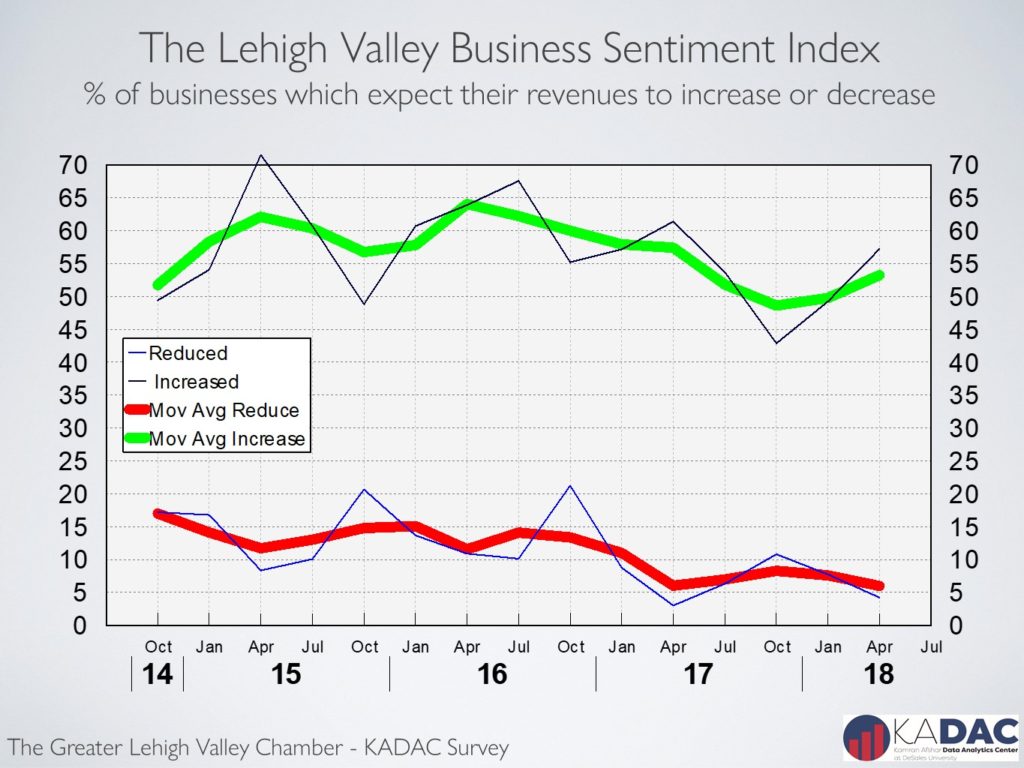

One of the surprising results of our surveys is the observation that the percent of local businesses which had reported increases in their revenues dropped well below its January 2018 level and is at a statistical tie with its April 2017. Also, of concern is the drop of the index of expected future revenues to below its April 2017 level.

The lower corporate and personal income taxes have moved from the roam of expectation to reality. The trillion-dollar infrastructure bill or anything resembling that is still an expectation. And while we will see increases in consumer and corporate expenditures, at least, through the middle of summer, its sustainability beyond that is being debated. It is however, very clear that the current tax breaks, will cause higher deficits, at the very least, early on. Since the labor market is at full employment level, and deficit is rising rapidly, inflation and higher interest rates are not far behind.