Lehigh Valley business sentiment index rose by only 3.1% in January

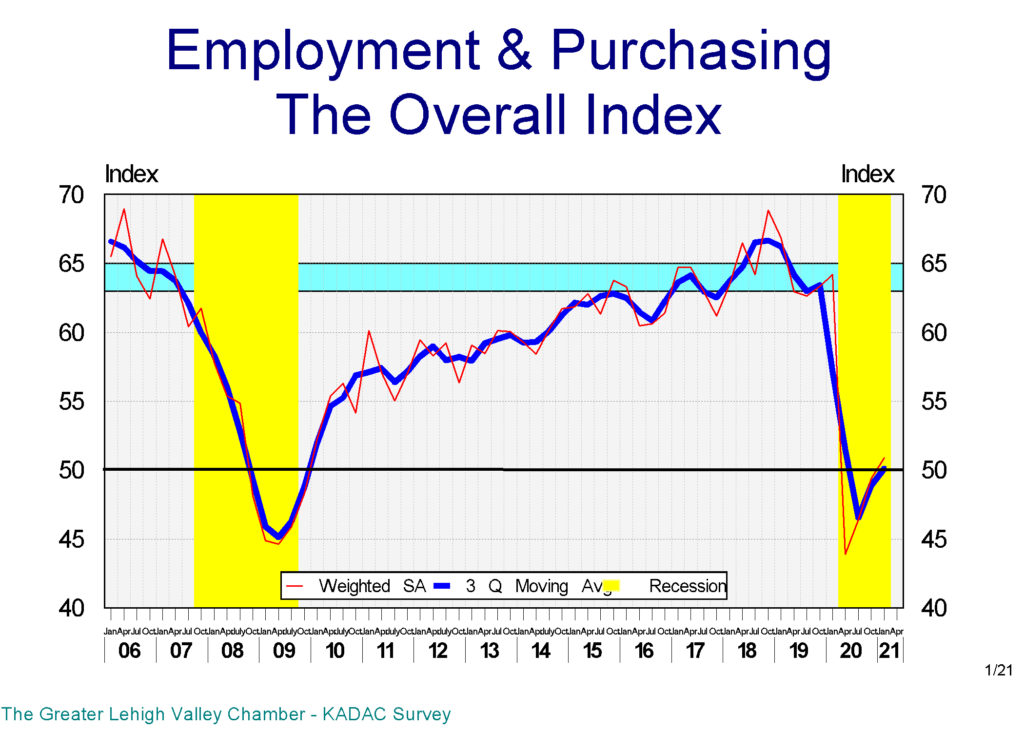

The Lehigh Valley’s business sentiment index, the BSI, made a smaller than expected recovery in January, rising by only 3.1%, a drop from last October’s 5.7% and last July’s 6.4% increases, after its historical 31.6% fall in April. Even after these three rises, BSI for January 2021 has only reached 50.9, well below its January 2020 level of 64.2. However, it has now exceeded its average level during the Great Recession. The diminishing rate of growth of the index is a cause for concern as it indicates a lack of enthusiasm among Valley businesses.

In our model, the largest gain was in the index of plans for future hirings, which rose by 7.3% above its last October’s level, while still 5% below its January 2020 level. It should be noted that this index peaked in October 2018 and was already down by 10.3% in January 2020. The drop in the index was a dramatic 17.8%, according to our April 2020 survey. And while it is now only 5% below its January 2020 level, it is a significant 14.7% below its October 2018 peak in the Valley.

One of the indicators that we calculate for our indices is their momentum. This indicator is the composition of the mass, strength, and direction of the index’s movement. And this indicator, which was at around 100 back in 2019 for future hiring, has dropped close to 60 as of January 2021. All of these indicate that despite its rise in January, the index of future hirings has a higher tendency to drop than to rise over the next 6 months.

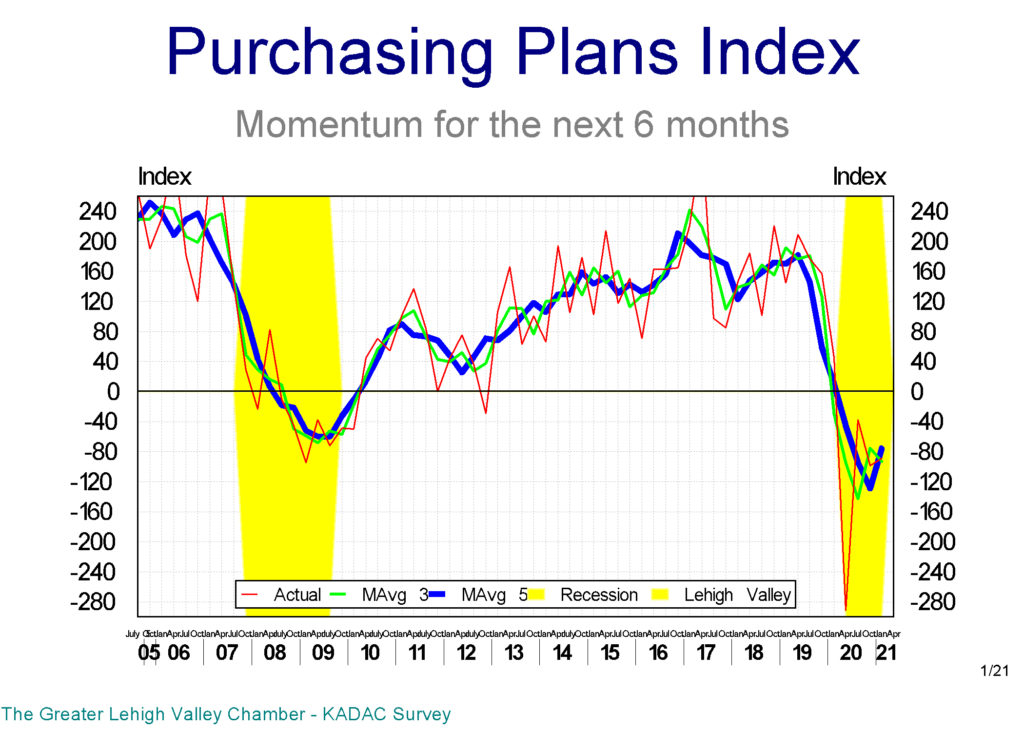

The only index in our model which did not rise in January was the index of future purchases index, which dropped slightly in January, pushing it down to 14.3% below its previous January level.

This index’s momentum is now in around negative 80, a massive drop from positive 160 back in 2019. The index of future purchases is also more likely to drop in the next 6 months than to rise.

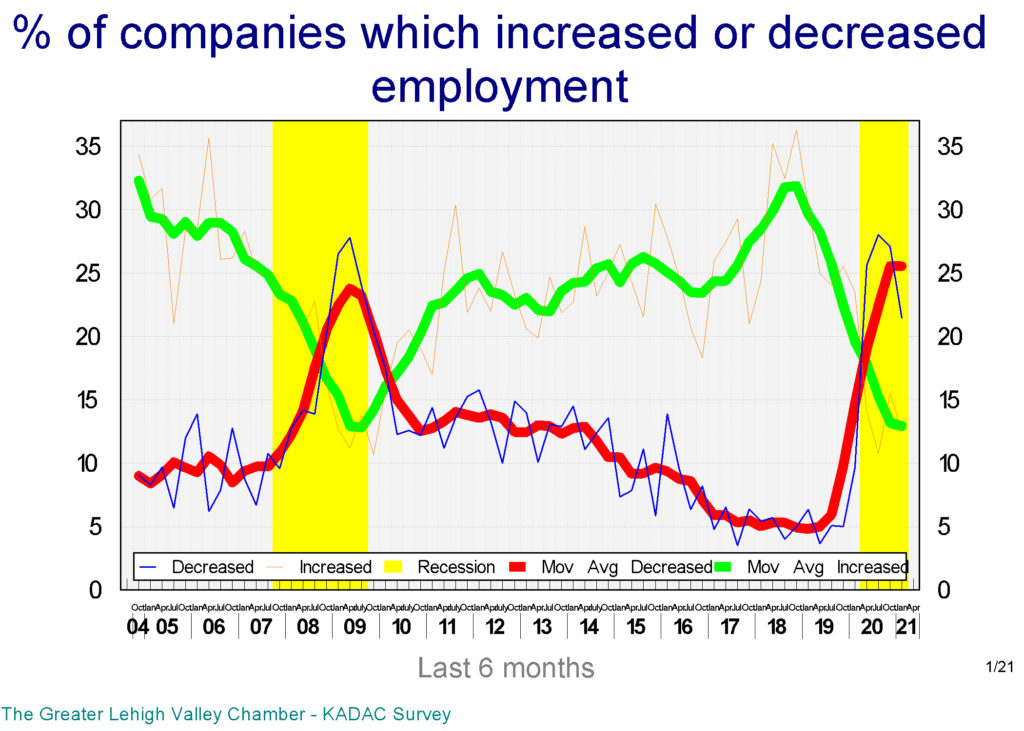

The hiring index over the last 6 months, which recorded a slight increase in January, is still 20% below its January 2020 level. This index’s momentum also dropped from an average of positive 50 in 2019 to an average of negative 40 by January 2021.

The percent of local companies that reported net layoffs was around 5% during 2018 & 19, while the percentage of those with net hiring hovered close to 30%. These ratios have changed dramatically; in January 2021, 21.5% of the participants in our survey had net layoffs, while only 12.5% of them reported net hiring. To put it simply, layoffs have increased by fourfold, while hiring dropped in half.

The index which has lost more than any other in our model over the last 12 months is the index of actual purchases, which fell to 42.6% below its January 2020 level. And its momentum is down from more than positive 200 in 2019 to around negative 300 in January 2021.

As was expected, the accommodation-food & leisure sector had the largest layoffs by far over the last 6 months, followed by construction and manufacturing.

The Finance-insurance sector led the plans for hiring over the next 6 months in January, followed by manufacturing and retail. And for the first time in almost a year, accommodation-food & leisure sector shows positive plans for future hirings.

Purchasing plans index dropped a slight 2.8% in January 2021, while actual purchases over the last 6 months rose by 4.9%. However, despite rising over the last two quarters, the index is still 42.6% below its January 2020 level.

The Valley has recovered/replaced 87% of all the jobs it lost in March and April of last year. And the finance and manufacturing followed by the accommodation-food & leisure sectors have the largest plans for expanding employment in the next 6 months.

And while all sectors except retail and real estate reported lower revenues over the last 6 months, the picture for the next 6 months is much more positive. And except for the accommodation-food & leisure and education sectors, none of the others expect their revenues to shrink in the next 6 months.

Our local business survey still shows a heightened level of concern with the future of the economy. However, we also observed positive signs among the local businesses regarding their hiring and purchasing plans for the next 6 months.