LV Business Sentiment January 2016

Businesses with 6 to 50 employees reported the largest increase in their planned hiring for the next 6 months

The Kamran Afshar- Greater Lehigh Valley Chamber of Commerce survey of Lehigh Valley businesses is done on a quarterly basis and collects about 800 observations per year. The Employment and Purchasing Index for the Lehigh Valley highlights the results of these surveys.

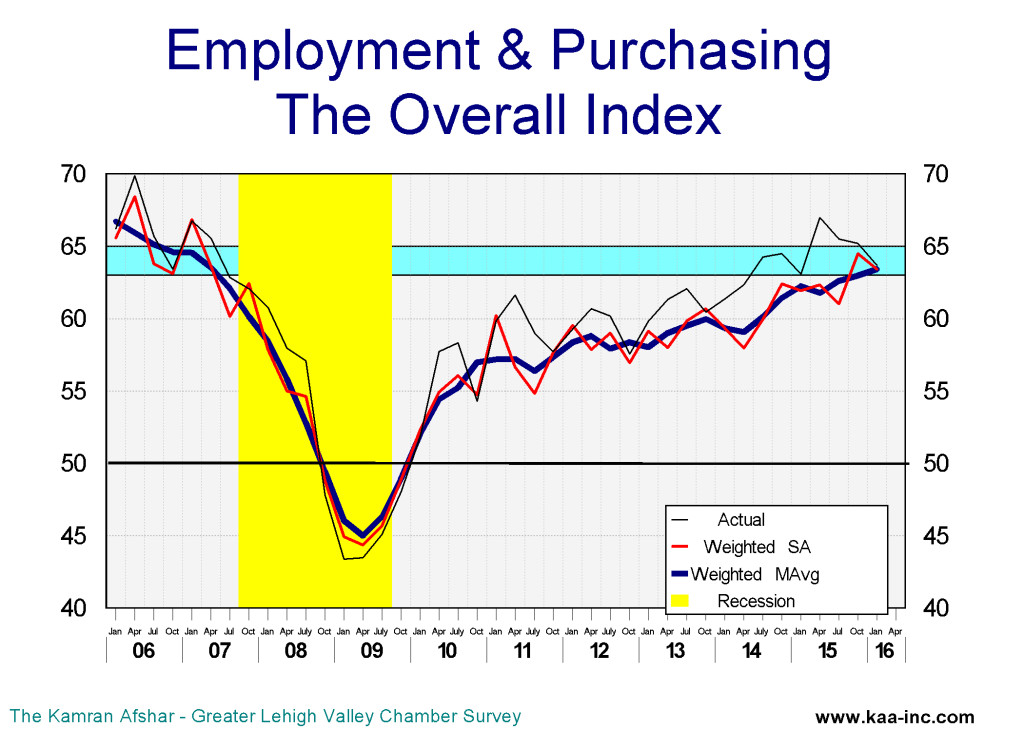

In January 2016 we conducted our 65th quarterly survey of this series. According to the survey, and despite the slight drop in January, the overall business sentiment is trending steadily upwards in the Lehigh Valley.

Business sentiment, as measured by the overall index eased down slightly to 63.4 in January, recording its second highest level since before the recession, the highest level was 64.5 back in October of last year. It should be noted that the highest level for the index (68.5) was reached in April 2006, and its lowest point was when the index fell to 44.4, in April 2009. And despite the slight drop in January, the Valley’s overall business sentiment trend is continuing to move up steadily, albeit slowly. The index and its long term trend are moving very close to the range that is historically associated with rapid growth.

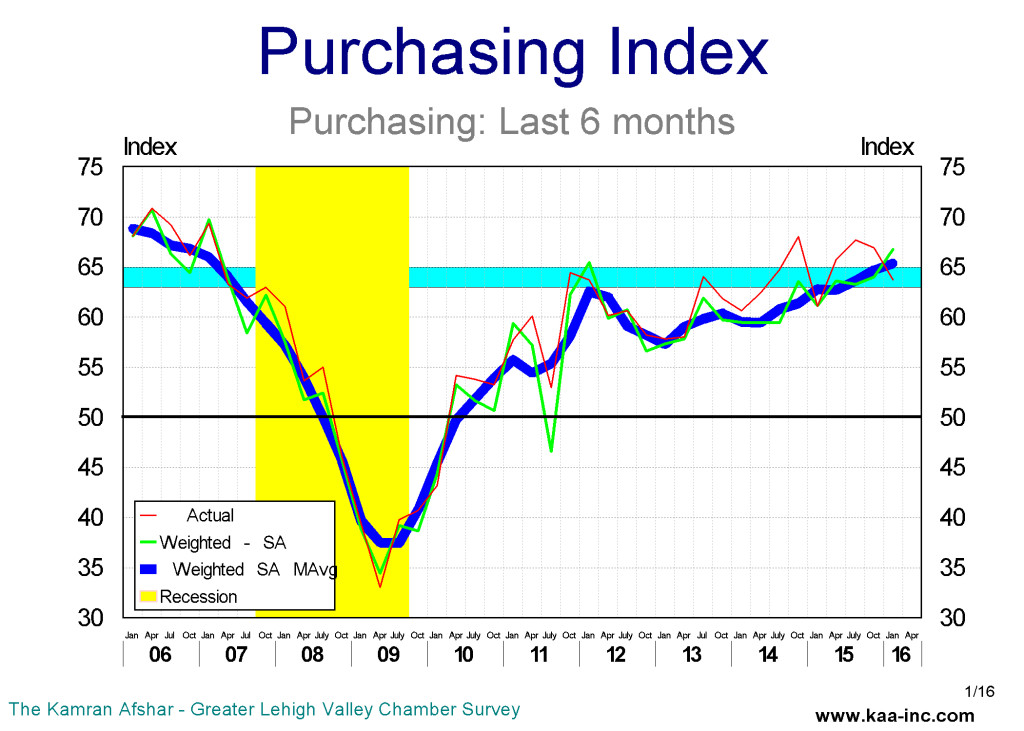

The only indicator in our model which recorded an increase in January was actual purchases in the last 6 months. This indicator, at 66.8 it stands 4.4% above its October 2015 level and 9.2% above its last January 2015 level. And it is at its highest level since before the recession. Local businesses have increased their expenditures more in the last 6 months than any time since 2007.

The only indicator in our model which recorded an increase in January was actual purchases in the last 6 months. This indicator, at 66.8 it stands 4.4% above its October 2015 level and 9.2% above its last January 2015 level. And it is at its highest level since before the recession. Local businesses have increased their expenditures more in the last 6 months than any time since 2007.

Over the last 6 months, 43% of the local businesses participating in our survey increased their expenditures while only 8% reduced theirs. The average business participating in our survey increased its expenditures, by 2.1% in the last 6 months.

The index for purchasing plans for the next 6 months at 64.9 is in a statistical tie with its October 2015 level. The index’s trend, however, is at its highest level since before the recession and is almost at the bottom of the “expansion” range for the first time since 2007.

While the percentage of companies which are planning to increase their expenditures has not measurably changed since October 2015, the amount of their planned expansion has dropped.

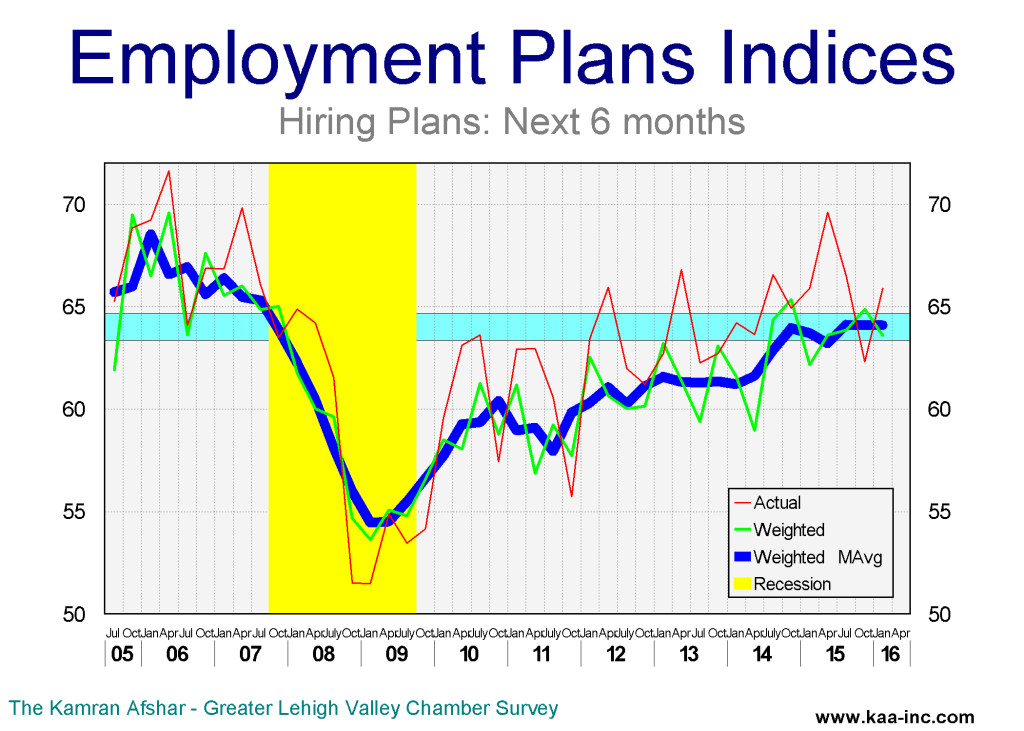

The hiring plans index for the next 6 months, has been almost flat since April 2015, while being slightly higher than last January’s level. This index has been running close to the range which is historically associated with rapid growth since April 2015. And all of this happened despite a significant decline in actual hiring in the last 6 months. Businesses with 6 to 50 employees reported the largest increase in their planned hiring for the next 6 months. The average business participating in the survey is planning to hire 1.1 more employees in the next 6 months. Going forward, healthcare, professional and technical businesses are planning to hire more people than others during the next 6 months.

The hiring plans index for the next 6 months, has been almost flat since April 2015, while being slightly higher than last January’s level. This index has been running close to the range which is historically associated with rapid growth since April 2015. And all of this happened despite a significant decline in actual hiring in the last 6 months. Businesses with 6 to 50 employees reported the largest increase in their planned hiring for the next 6 months. The average business participating in the survey is planning to hire 1.1 more employees in the next 6 months. Going forward, healthcare, professional and technical businesses are planning to hire more people than others during the next 6 months.

A third of all businesses participating in our survey are planning to hire more people, while only 6% of them plan to lay off employees in the next 6 months. Plans for layoffs are now similar to what they were prior to the recession.

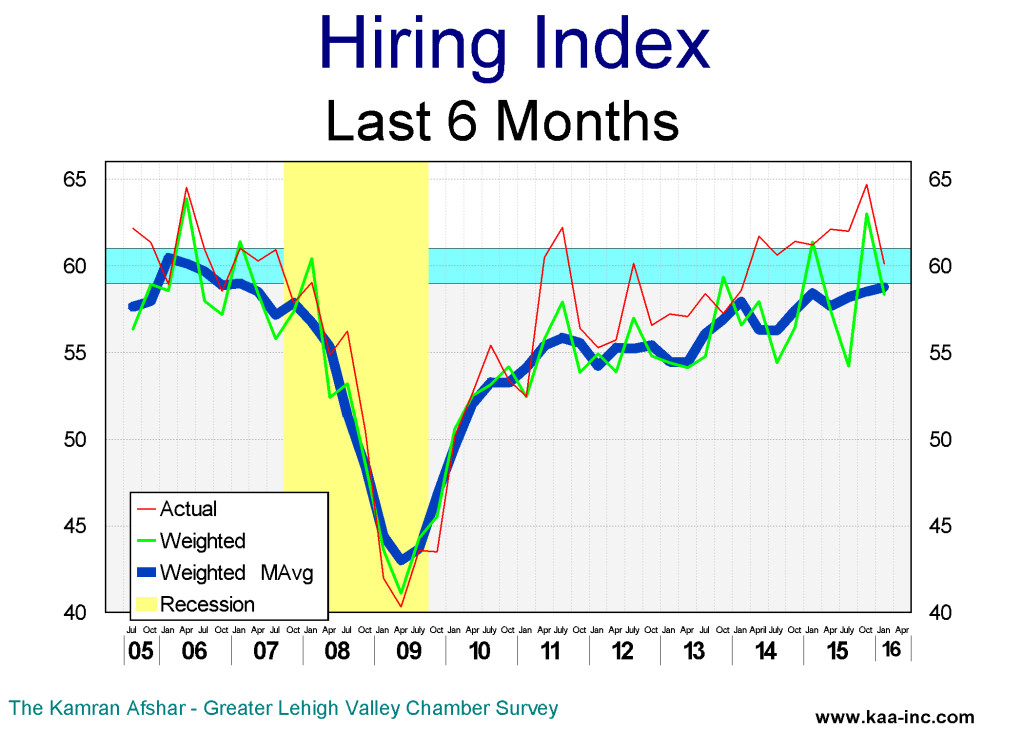

In contrast to increased plans for future hiring, the index for actual hiring over the last 6 months dropped by 7.3%, the largest decline among the January indicators in our model. That somewhat correlates with the drop in total employment in the Valley over the last 6 months.

In contrast to increased plans for future hiring, the index for actual hiring over the last 6 months dropped by 7.3%, the largest decline among the January indicators in our model. That somewhat correlates with the drop in total employment in the Valley over the last 6 months.

However, despite the dip in January, the index of actual hiring is trending upwards, and is closing in on its pre-recessionary levels. Businesses with more than 50 employees reduced their new hiring significantly in the last 6 months, while those with less than 21 employees increased theirs slightly. The average business participating in the survey hired 0.6 employees over the last 6 months. Manufacturing, transportation warehousing and information related businesses reduced their employment levels while healthcare and professional / technical businesses increased theirs.

Over the last 6 months, 28% of the local businesses participating in our survey expanded their employment while 14% reduced theirs.

The index for purchasing plans for the next 6 months is in a statistical tie with its October 2015 level. Despite that, its trend has almost reached the range which is historically associated with rapid growth.

Fifty-seven percent of the businesses participating in our January survey reported

increases in their revenues over the last 6 months, while 19% experienced a decline in theirs. Expectation of higher future revenues jumped significantly from only 49% in October 2015 to 61% in January 2016. Also the percent of companies which expect to see lower revenues in the next 6 months dropped in January to 14%, down from 21% recorded the previous October.

Based on the results of our January survey we expect the Valley’s economy to return to its previous slow but steady growth. The slower than expected growth during the 4th quarter of last year which resulted in a decline in local employment appears to be behind us. The expectation is that local employment growth will resume, albeit at a slower pace, by spring. Based on labor pool and the projected growth data, we also expect to see a measurable increase in local wages in this year.