Despite the oil oversupply, the US Energy Information Administration is forecasting a significant price increase in 2016

Forecasting oil prices with any reasonable accuracy appears to be beyond the scientific abilities of most economists including this one.

Basic methodology of any price analysis is to brake the market into its primary components, supply and demand.

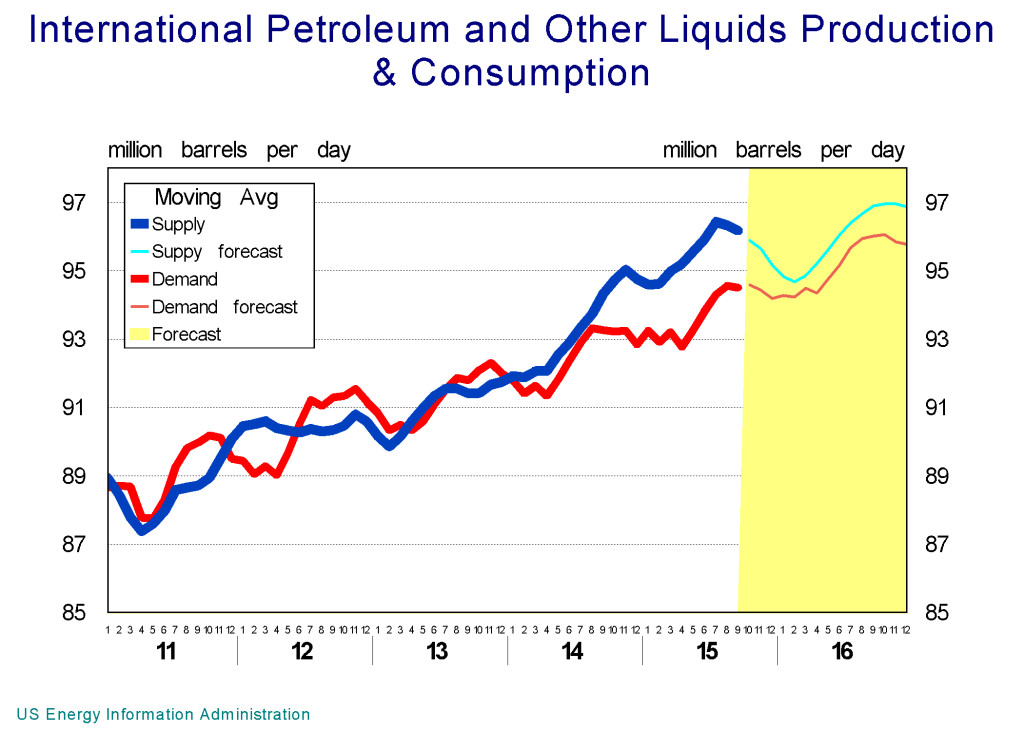

Global supply of oil during the first half of 2014 was hovering at around 92 million barrels per day, slightly more than 0.5 million barrels higher than global oil consumption (demand) a small over supply according to the US Energy Information Administration. Despite of that oil prices rose by about 5% in the first half of 2014.

Oil production started a rapid increase during the second half of 2014, rising to more than 95 million barrels per day by the end of the year. Global Demand for oil as measured by consumption, responding to the huge drop in prices also rose, but only to slightly higher than 93 million barrels, resulting in further increase in surplus.

Cushing Oklahoma is a vital transshipment and storage facility in US, its storage reserves was estimated at 20 million barrels in June 2014, by the end of last year its reserves rose to more than 30 million barrels an increase of 50%.

Thus far the basic tenets of economics has worked, as supply increased rapidly, prices dropped and inventory rose.

However, the increase in production was only 2% by the end of 2014 and rise in demand accounted for half of that increase, so a prices decline of 44% drop appears excessive. Here is where we have to make some minor adjustments to the basic pricing model.

In reality price models are by far more complicated, we have to allow for a number of other variables, some straight forward like inventory, which in this case recorded a major increase, and some more complex like expectations of future supply and demand and an array of different variables, including the asymmetric production cost variables. And then of course there are all the “non-economic” variables like political tensions, wars, etc.

Between January and June of 2015 supply of oil remained relatively constant close to 95 million barrels per day, and there was a slight drop in consumption. Resulting in an average surplus of 2 million barrels per day. Cushing oil reserves vaulted up by 81%. Despite of these, price of oil rose by 27%, during the same period.

As of the end of October, Cushing reserves were two-and-a-half times what they were at the end of October of 2014. Total oil supplies is estimated at 96 million barrels per day close to around 2 million barrels higher than total global demand for oil. And US Energy Information Administration forecasts a continuation of significant surplus production for the balance of this year and 2016. However, and all at the same time they also forecast a significant 20% increase in price of oil by next June. An interesting puzzle!

Data source: US Energy Information Administration