The Lehigh Valley business sentiment index has been dropping since mid-2022

The Lehigh Valley’s Business Sentiment Index (the BSI) peaked in July 2021 at 64, then went sideways through April 2022. As inflation started to skyrocket, the index began to drop. The overall index for July at 56, is 4% below April of this year and 5% below its July 2022 level.

The BSI is based on the quarterly survey of businesses in the Valley conducted by the Greater Lehigh Valley Chamber of Commerce- Kamran Afshar since 1998.

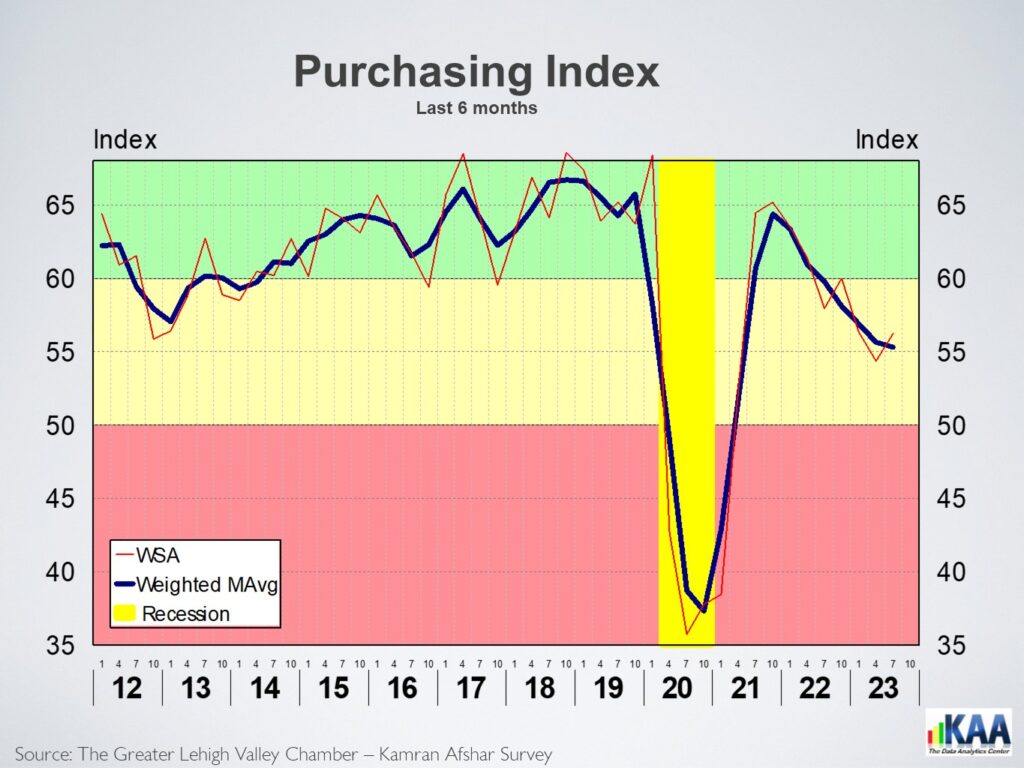

The only component of the index which recorded a measurable increase is the index of past purchases, which rose by 4% in July. Real estate and healthcare led the increases, while manufacturing and construction led the declines.

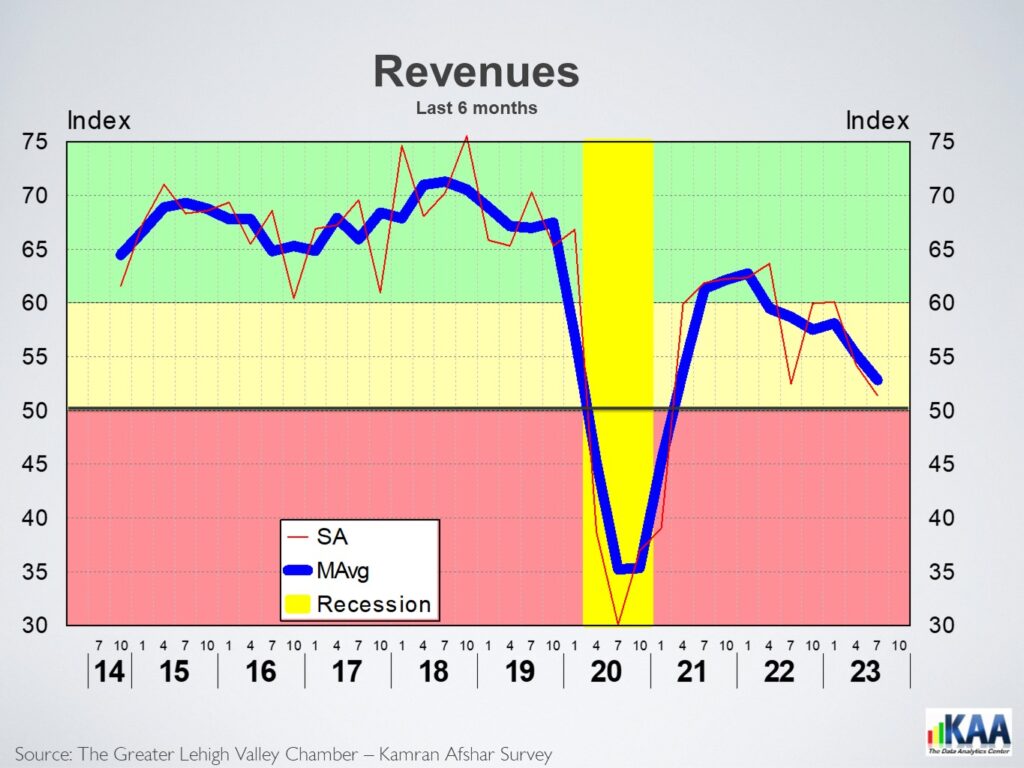

The index of expected future revenues showed a slight increase. Healthcare, finance, and manufacturing led those expecting larger increases in their revenues over the next 6 months, while construction and accommodation-food sectors expected future reductions in their revenues.

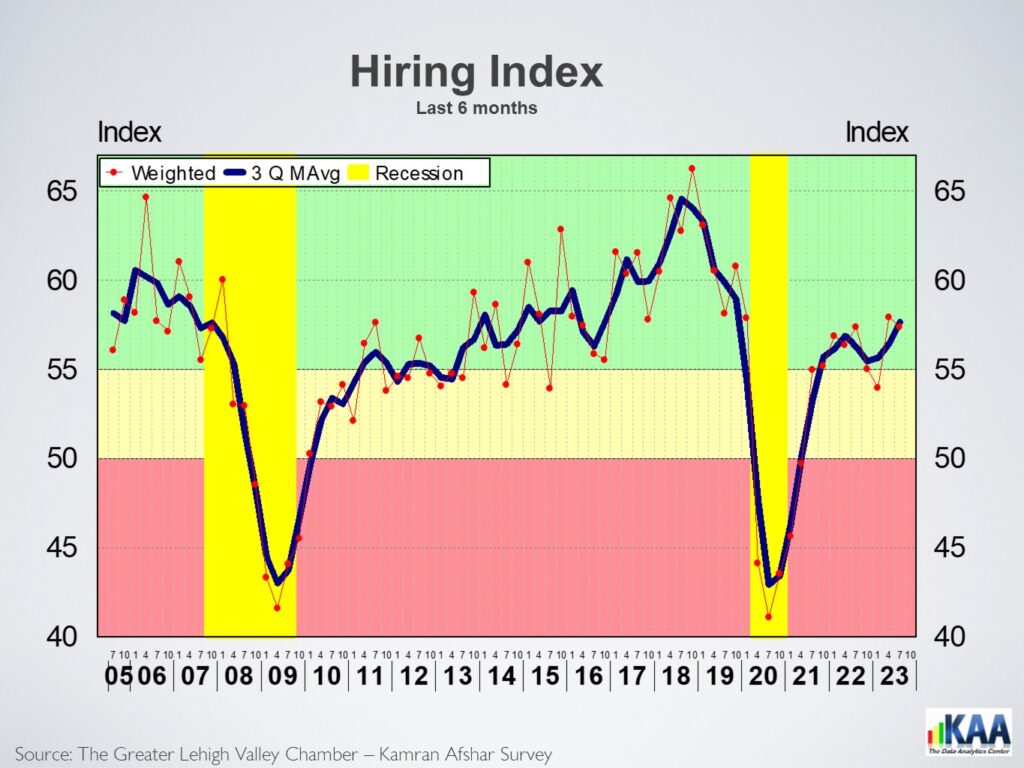

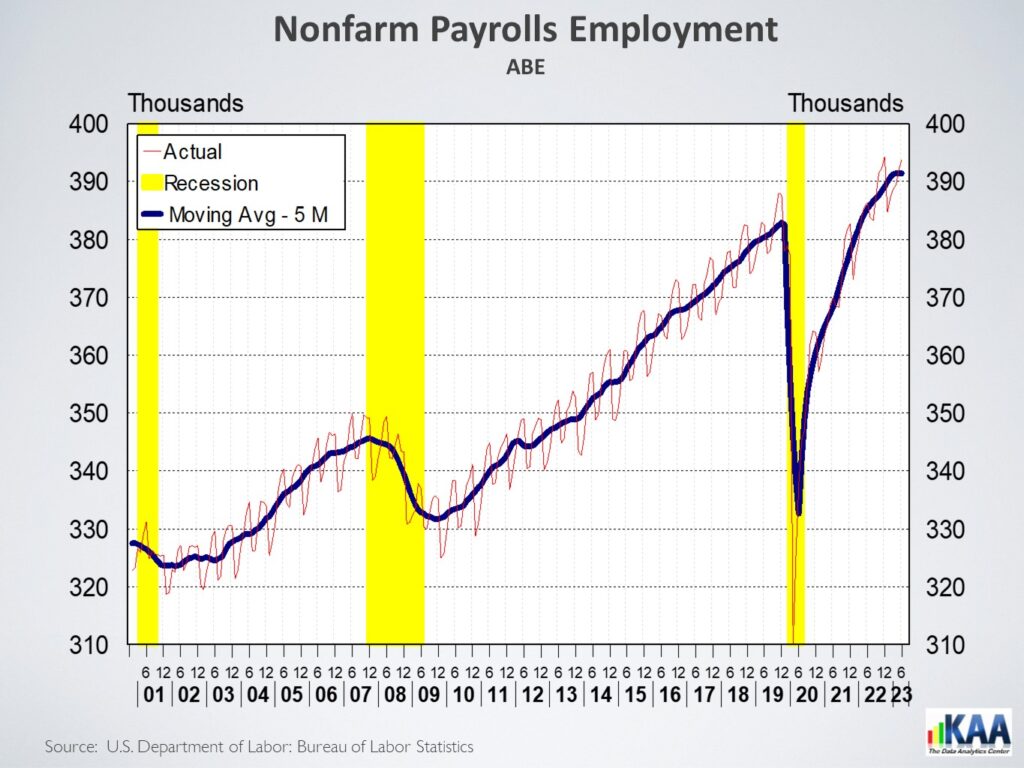

In July, the index of past hiring is in a statistical tie with its April level and at the same level as in July 2022. As reflected in the 7,500 new local payroll jobs created in the last 12 months in the Valley. However, local employment growth is slowing down, as in July 2022, this number was twice as large. One of the reasons for the slowdown in hiring is, availability. Healthcare and finance led the sectors with the highest hiring levels, while Transportation-warehousing and manufacturing had the layoffs.

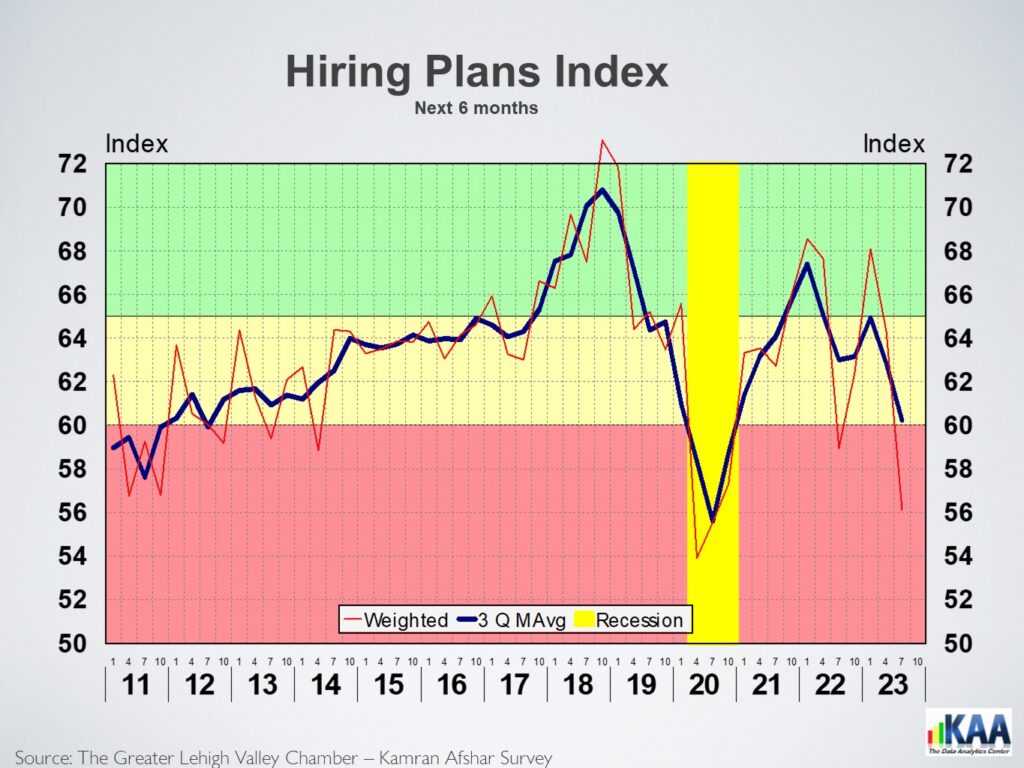

The largest drop in July was in the index of plans for future hiring, which dropped by a significant 13% below April’s level. This index, at 56, is at its lowest level since July 2020, when COVID was still raging. Many employers have reduced their future hiring plans due to lack of success in meeting their current hiring goals.

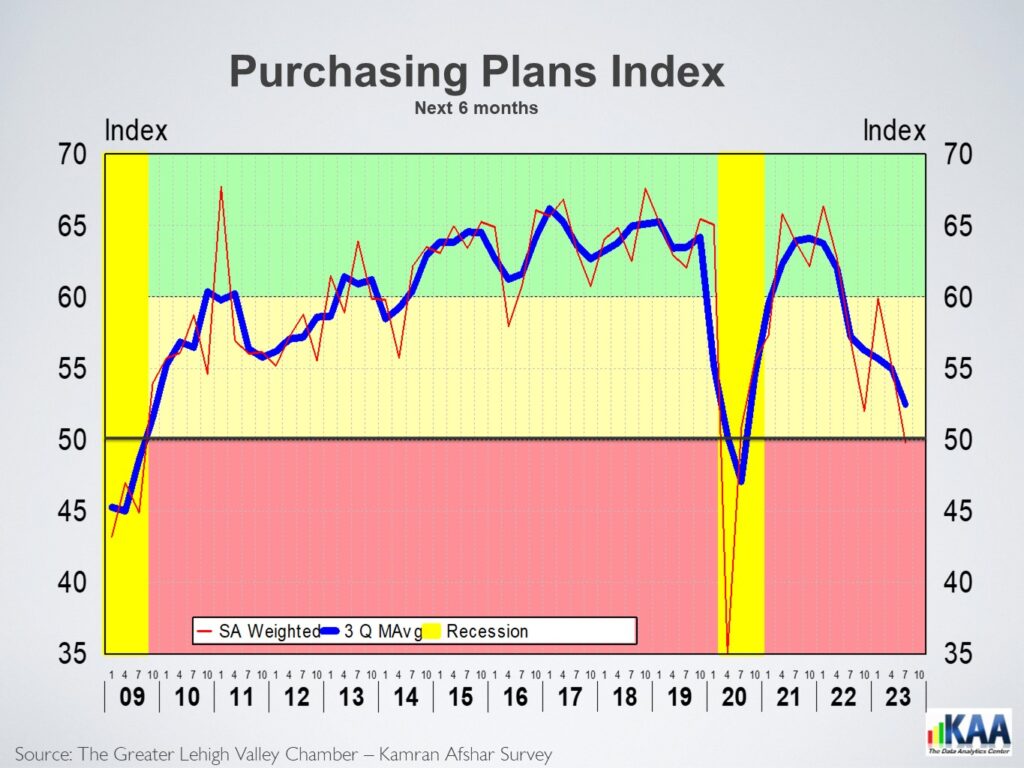

The index for plans for future purchases dropped by 10% in July, falling to 50, its lowest level ever during normal times. The last three occasions this index was this low were during the COVID recession in 2020 and the Great Recession in 2009 and the 2001 recession.

The index for revenues over the last 6 months dropped by 5% in July. Manufacturing and construction sectors reported the largest revenue drops, while healthcare and retail sectors led the revenue gainers.

The July drop in the Valley’s business sentiment is the 4th drop in the index over the last 5 quarters. The customer sentiment index was also dropping before reversing course in June, so we expect the Valley’s BSI to also start to improve. Something that we will find out after the October survey.