The Lehigh Valley business sentiment Shows a slight improvement

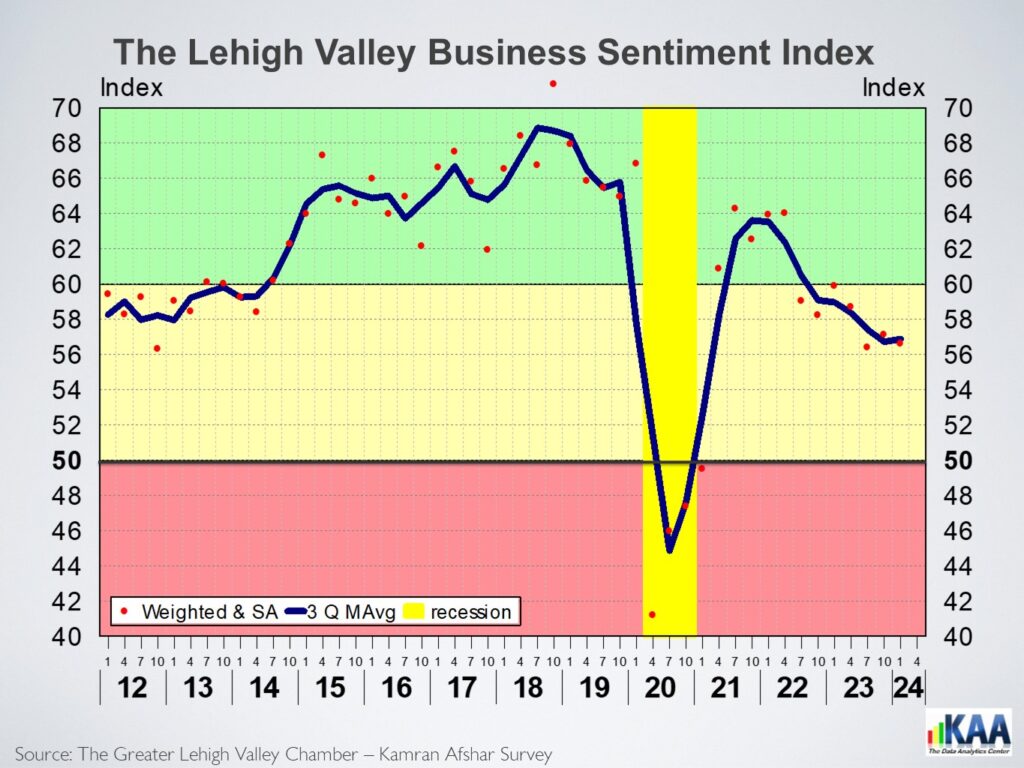

The Lehigh Valley’s Business Sentiment Index (BSI) post-COVID peaked in July 2021 and dropped as inflation rose. As inflation started to subside, the index stopped falling, and since last July, the index is trending has slightly up. The BSI is based on a quarterly survey of businesses in the Valley conducted by the Greater Lehigh Valley Chamber of Commerce- Kamran Afshar since 1998.

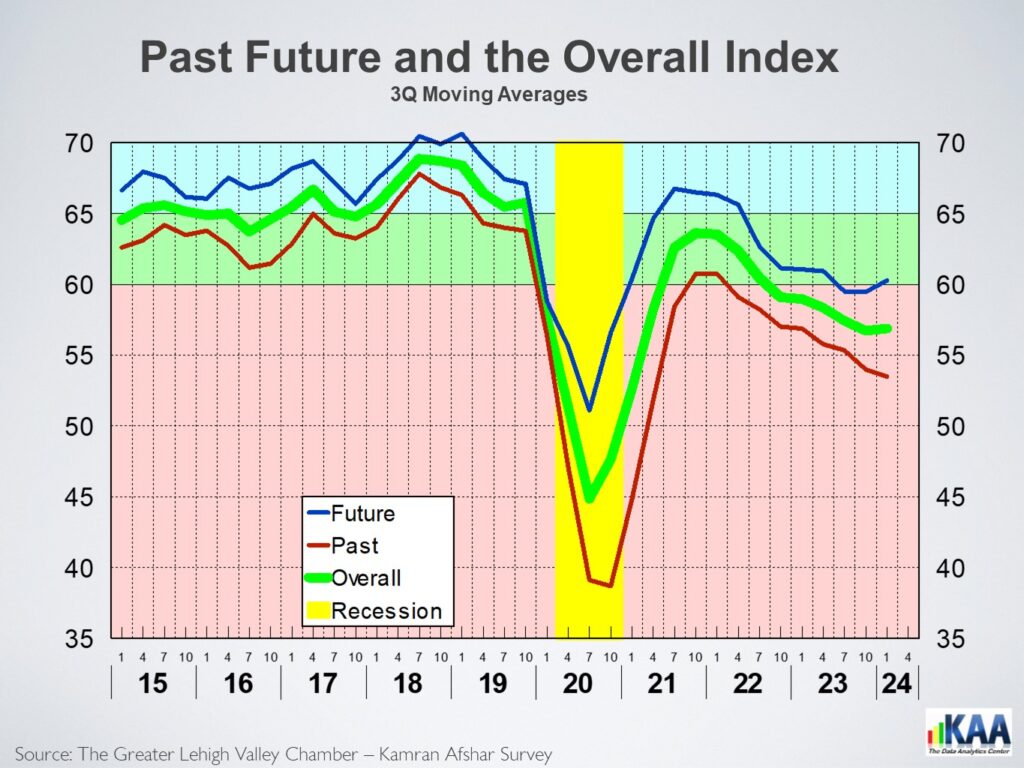

While the index was statistically tied with its October and July levels, it was 5.5% below last January’s due to the drop in purchasing and past revenue indices. It is, however, significantly above its January 2023 level regarding the expectation of future revenues. The overall index stands at 56.6 for January 2024. We have benchmarked the index to year 2000 as 100; based on that, the January index is 82.5.

In comparison to last October, three of the six indices in our model were down, one was up, and the remaining two, while positive, were statistically ties to their October levels.

The index of past hiring fell 7.5% below its October level, which reflects the slowdown in hiring in the Valley. Information, healthcare, and construction led the hiring, while retail and accommodation-food led the layoffs. Most of the hiring was done by businesses with more than 100 employees, while the largest layoffs were those with 51 to 100 employees.

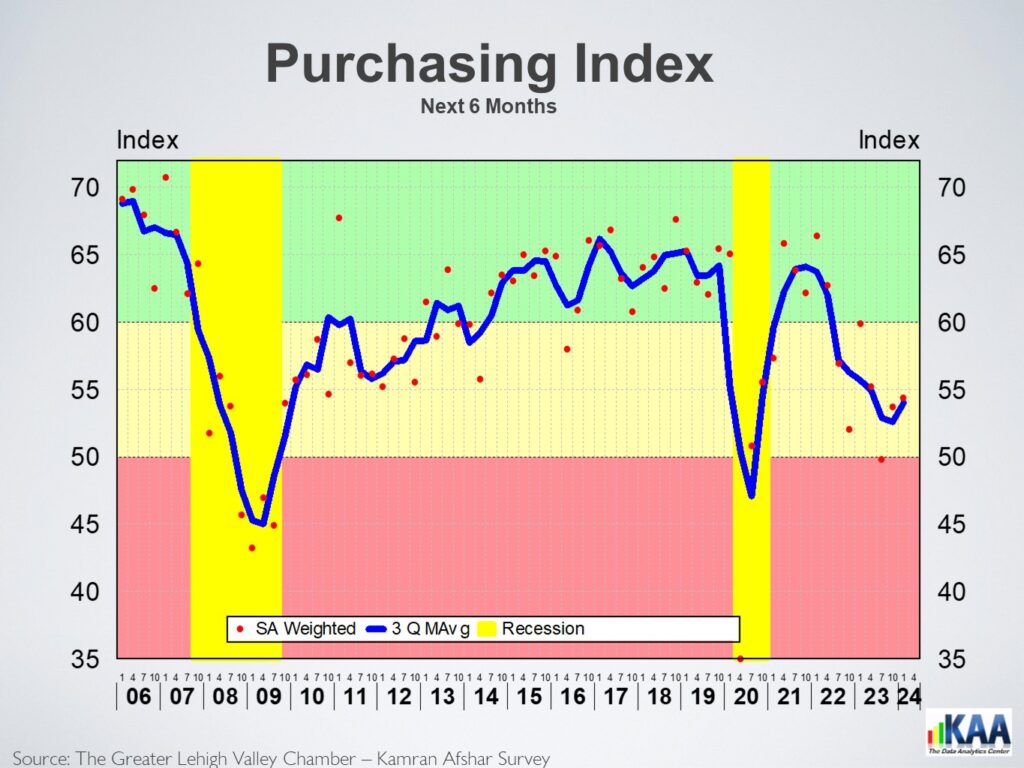

The index of past purchases dropped 5% in January. Manufacturing and finance led the reductions, while transportation-warehousing and construction sectors led the increases.

While the index of plans for future purchases rose in January, the increase was not statistically significant. Education, finance, and transportation-warehousing sectors led the plans to increase expenditures, while real estate and retail led those planning to reduce expenditures in the next six months.

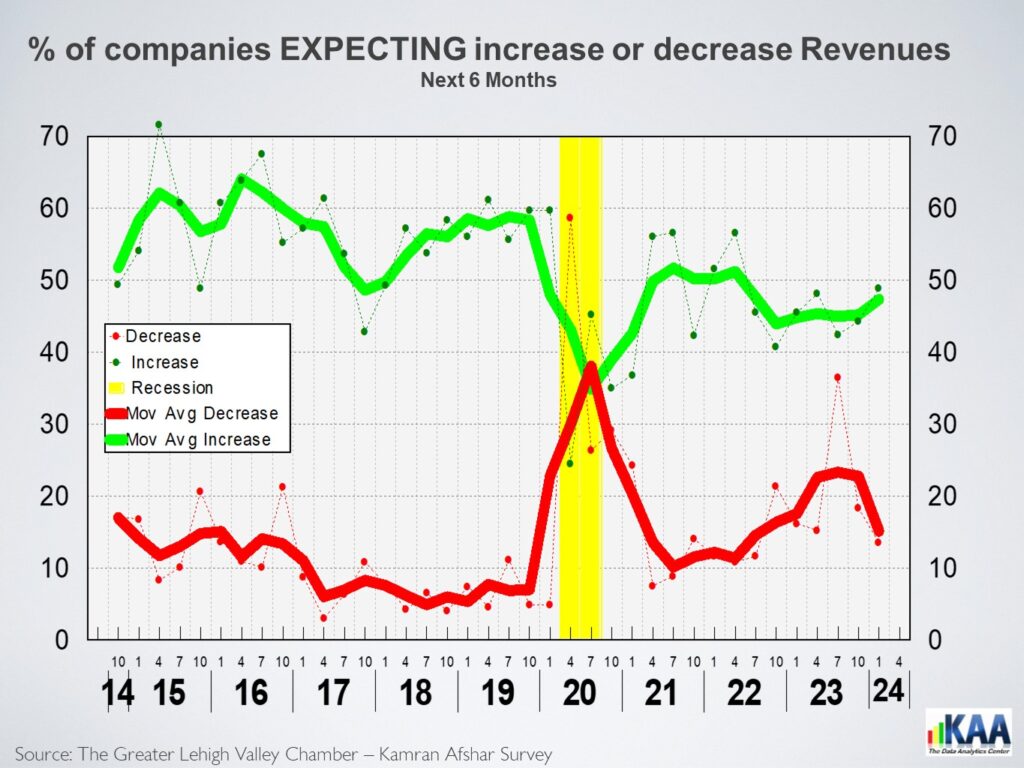

The index of past revenues registered the largest drop, falling 10% in January. Half of the business categories in our model, led by real estate and accommodation-food, reported declining revenues over the last six months. Finance and transportation-warehousing led the other half, which reported rising revenues.

While the expected future revenues’ index increase is not significantly higher than its October level, it is 4.5% higher than its January 2023 level. Education, construction, and healthcare led most of the business categories in our model, expecting higher revenues in the next six months. Retail and manufacturing were among the few who expected declining revenues.

The Lehigh Valley business sentiment index trended down from the middle of 2022 to July 2023; it has since reversed direction. A large part of this is due to reduction in labor market churn, as businesses reported significant decreases in both hiring and layoffs. Also, regarding future expectations, there has been an increase in the percentage of respondents anticipating higher revenues, coupled with a significant decrease in those expecting lower revenues. The Data shows that despite the drop in the assessment of the current economic conditions, expectations of the economy’s future have been rising since last summer. This is a positive indicator for the Valley’s economic outlook over the next six months.