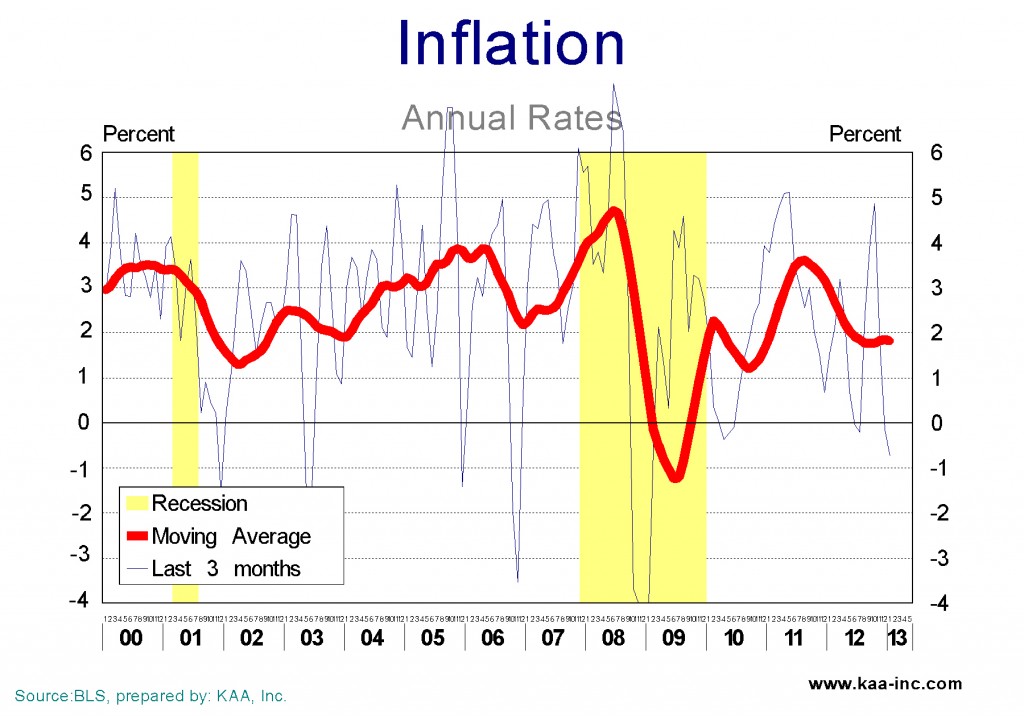

What happened to Inflation?

Inflation which was starting to show its ugly face back in 2007-08 was wiped out alongside 8.7 million payroll jobs, the booming housing market, more than 500 commercial banks as well as a large number of other businesses during the Great Recession of 2007-09. The FED also was not all that active during the early months of the Great Recession. The FED eventually discovered in September 2008 that the alarms were for real, and to its credit, it then went to town on raising the money supply. By January 2009 the monetary base was more than doubled. The FED continued to push high powered money into the economy and currently the monetary base is more than 3 times its pre-recession level. Despite pushing all this money into the system, inflation is exceptionally tame. What gives? The Great Recession does. The economy is so badly battered that the velocity of money (the rate of circulation of money in the economy) has crashed, thus while a lot more money is in the economy to go around, since it is circulating a lot slower than it used to, the result is low inflation.

As the recovery gets its running legs back, and employment increases, and businesses start to experience larger and larger sales, the first thing that is going to happen is an increase in the velocity of money. That increase will set a number of alarms off at the FED, if they don’t switch off the alarms again, they will start to pump money out of the economy as fast as they can. Their tool for doing this is selling some of the bonds and papers they have been hoarding in the last four years. This will increase interest rates. Tighter monetary policy is a certainty, the only questions are when are they going to start and how hard are they going to apply the brakes.