Category Archives: KAA Blog

LV Purchasing & Employment Plans Index

Local businesses’ index of planned expenditures for the next 6 months leaped 9.5%.

KAA surveys Lehigh Valley businesses on a quarterly basis and collects around 800 observations per year. The Employment and Purchasing Index for the Lehigh Valley highlights the results of these surveys. In July 2013 we conducted our 55th survey of this series. The following is a summary of our findings.

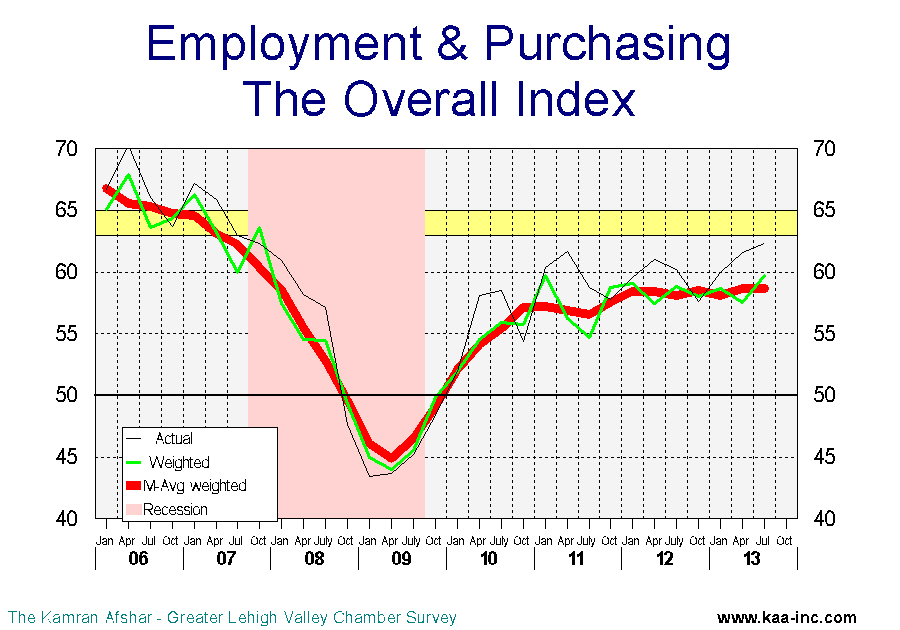

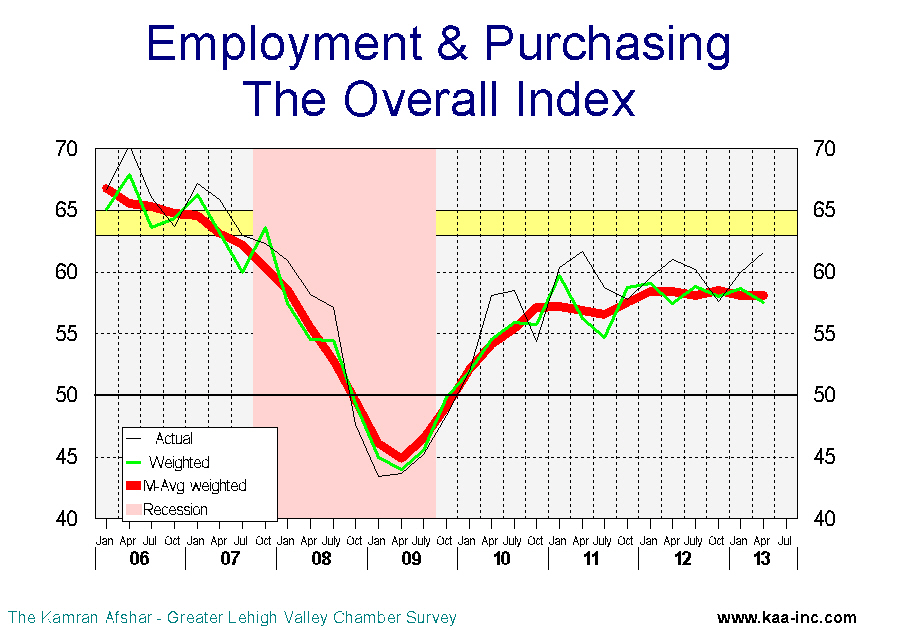

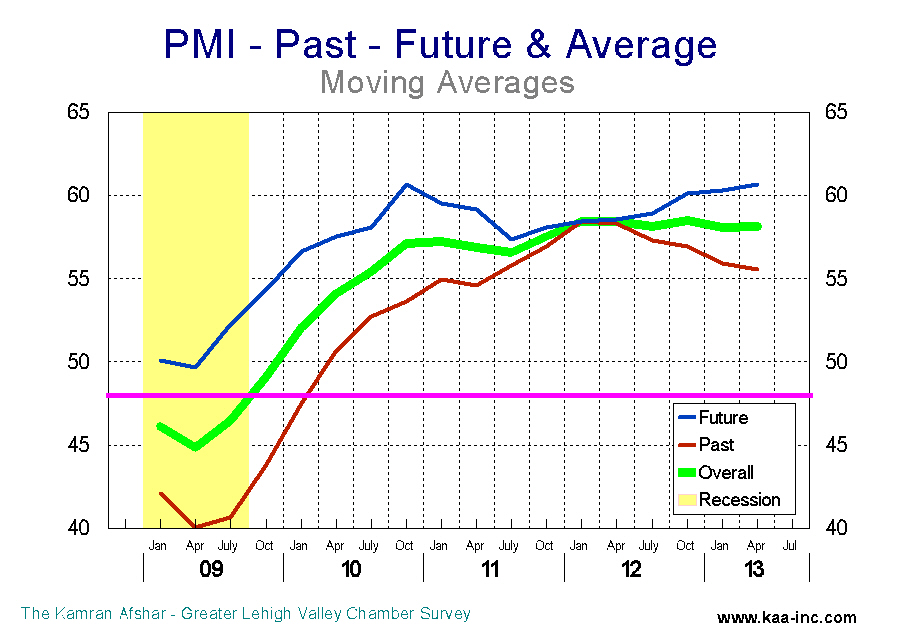

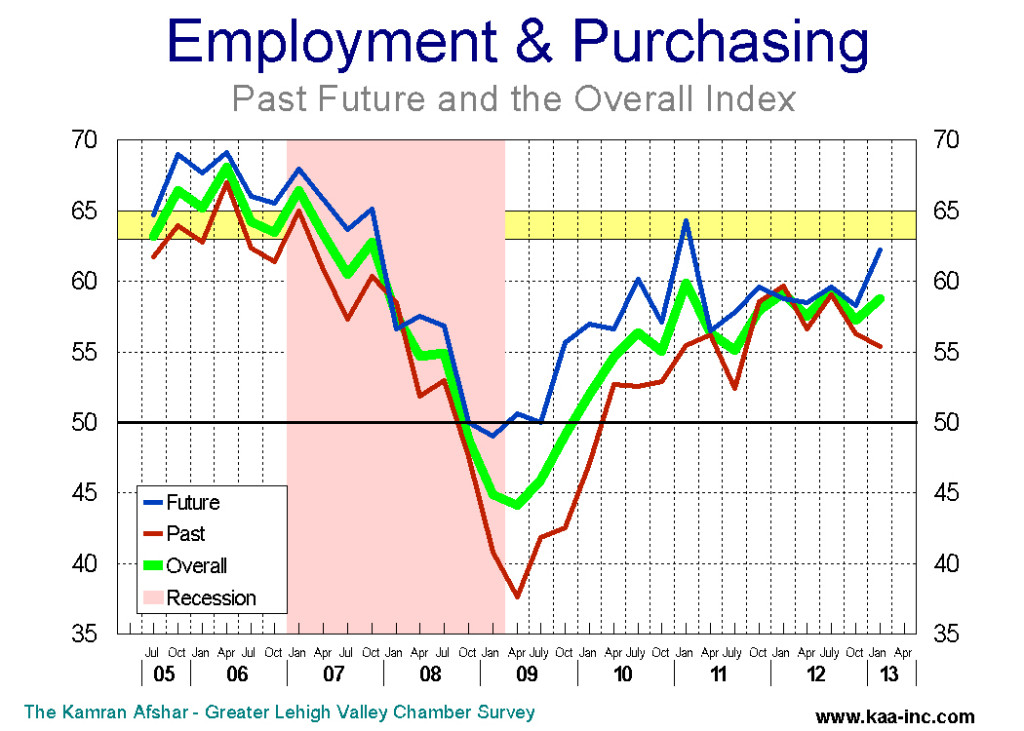

Business sentiment, as measured by the overall index rose slightly to 59.7 (seasonally adjusted weighted average, SAWA) in July 2013, a 3.7% increase over April 2013 and 1.4% over July 2012 levels. This is the second time the overall index has reached this point since October 2007. Any index above 50 means more than half of the participants were positive about the economy.

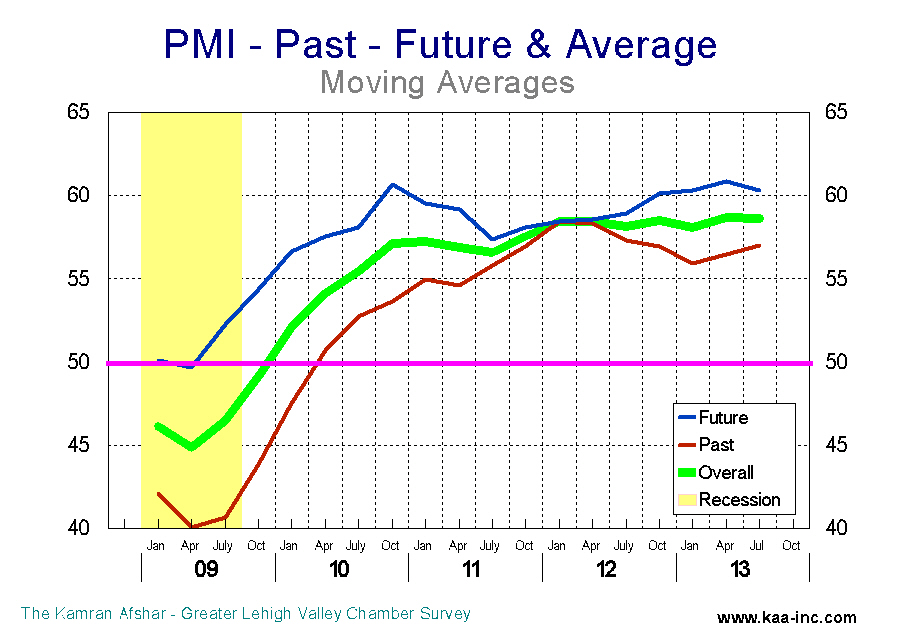

In general, participants were more positive about the future than the past. This is not dissimilar to the January survey results whereby participants were also more positive about the future than the past.

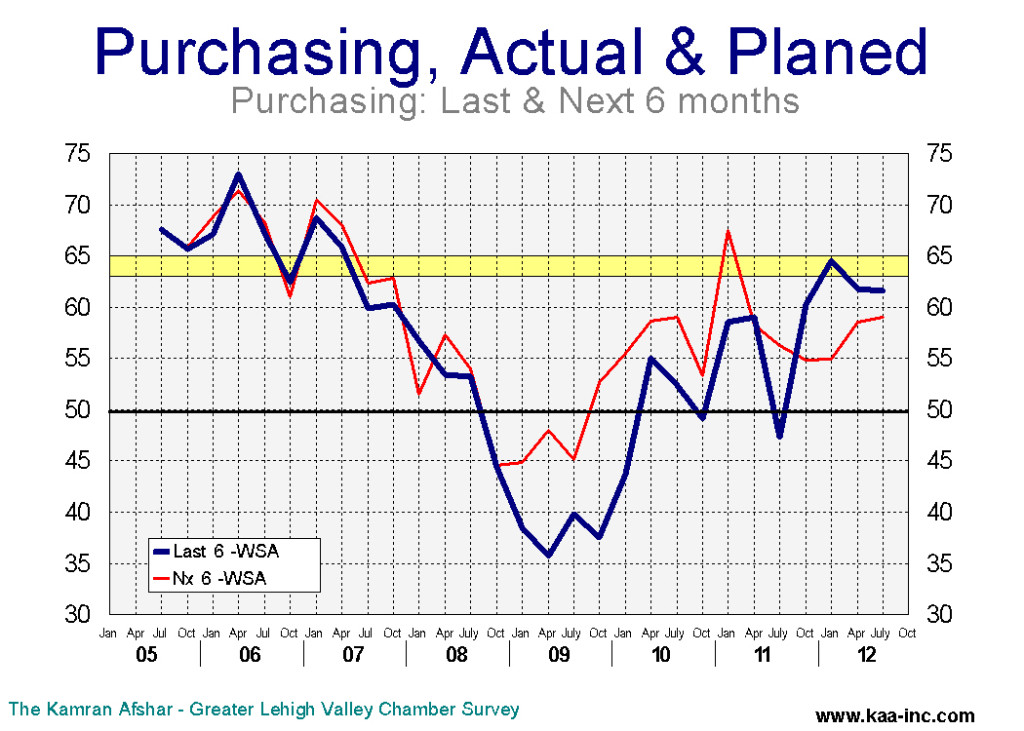

The largest gain as measured against April and also July 2012 was in the index for planes for future expenditures which leaped by 9.5% and 8.7% respectively.

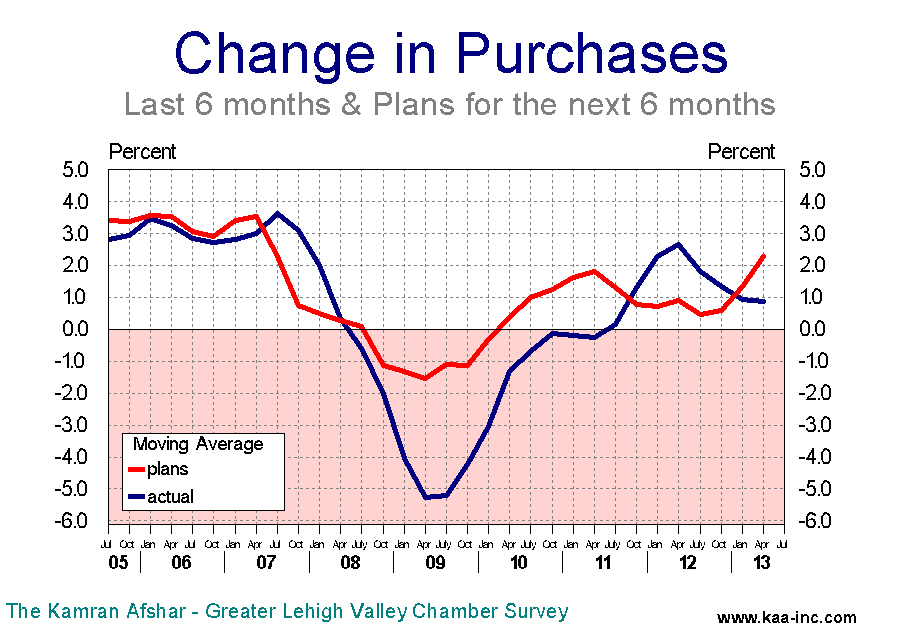

The index of purchasing plans for the next 6 months soared to 63.3, a gain of 9.5% over April and 8.7% over July 2012 levels, the second highest level since October 2007. The average business participating in the survey increased its expenditure plans for the next 6 months by 1.9% (moving average).

The second largest gain in July was in actual expenditures during the last six months. This index rose 7.7% above its April level. However, it is only 2.0% above its July 2012 level.

The index of actual expenditures over the last 6 months rose slightly to 61.9 (SAWA) in July 2013. This index rose to 64.2 in January 2012. Lehigh Valley companies began to increase their expenditures from the middle of 2011 at an increasing rate through July 2012. Then the index, while still in positive territory started to decline, dropping to 56.3 by April 2013. July was the first significant increase in the index since October 2011.PMI3 In January 2013, the average participant in our survey raised its expenditures by zero percent, compared to the previous 6 months. This indicator saw a sharp rebound in April when the average participant raised its expenditure by 1.7%, and in July this number rose to 1.8%. We expect to see more increases in this indicator over the balance of 2013.

Between October 2011 and October 2012 planned increases for future purchases dropped below actual increases in past expenditures. This was quite disconcerting because it indicates an expectation of worsening economic conditions in the future.

However, the good news is that for the last three quarters, the order has been restored and planned increases are again running above actual increases in each quarter.

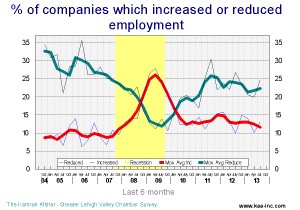

The index of “how many people did you hire in the last six months” rose slightly to 54.5 (SAWA) from 54.0 in April. It is still 3.9% below July 2012. While this index is generally rising, it is two steps forward one step back, which is of course better than all steps backward.PMI5

Despite that, between April and June 2013, there were 3,600 (seasonally adjusted) Jobs created in the Valley, which is in line with our April 2013 forecast of 6,600 new jobs in the following six months.

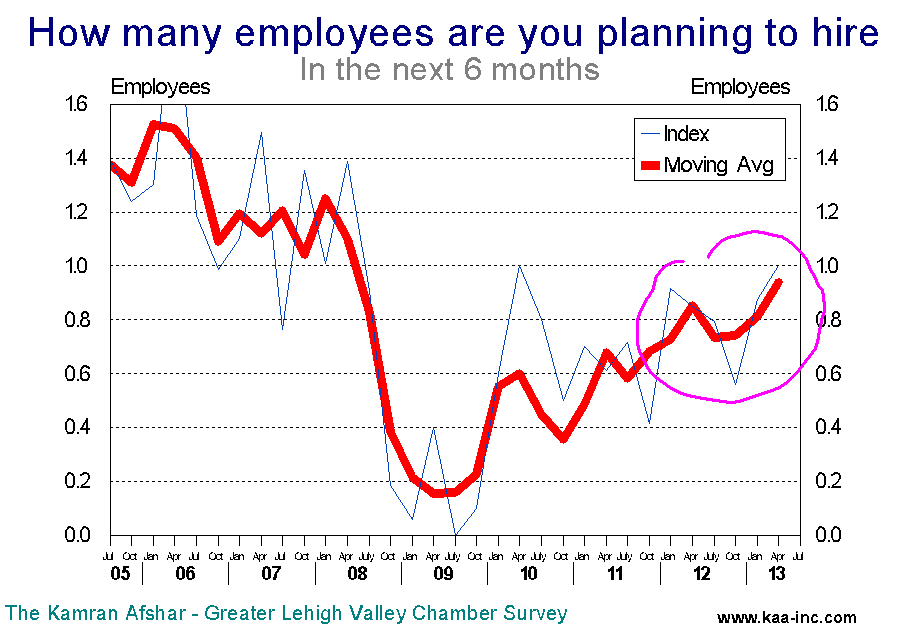

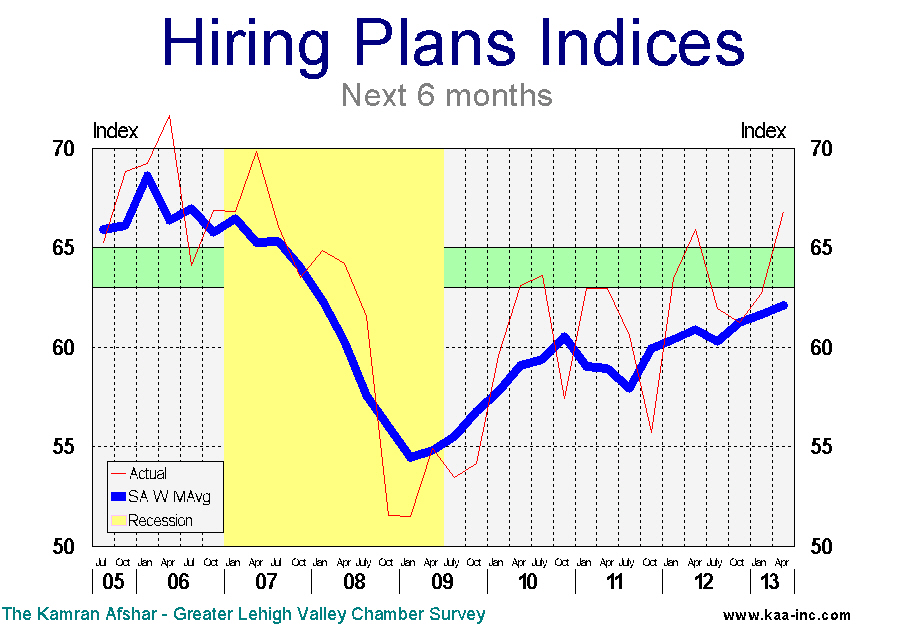

The only indicator which dropped below its April 2013 level was “plans for future hiring” this index dropped by 3.1% indicating concern among local businesses about the future of the economy. This index has been dropping since January 2013. It should be noted that while this number is below January and April levels, it is still in the positive, indicating that businesses are planning to hire more people, just not as many as they thought earlier this year.

Local businesses are planning to increase employment significantly over the next 6 months. The average participant in the survey is planning to add 0.6 employees in the next 6 months. This translates to 5,200 new employees over the next 6 months.

The percentage of the companies which increased their employment has been exceeding those who reduced theirs since April 2010. And, in general, the percent of those increasing has gone up more than down since the end of the recession. Conversely, the percentage of those decreasing employment has gone down more than up during the same period.

The percentage of companies with net gain in employment has increased steadily during the last 3 quarters.

In the previous issue we referred to local businesses changing their assessment of the past and future of the economy in a positive way. We have more evidence that the trend is continuing. This is the fifth quarter in a row when expectations of the future exceeds the assessment of the past. Since the beginning of this year, assessment of the past is also starting to slowly improve.

We expect the Valley’s economy to continue its positive improvement over the next 6 months. And expect local companies to significantly increase their expenditures as well as local employment to also show a sizable increase in the next 6 months.

Overall, our expectation for this fall is a brighter economy.

Are the new jobs created after the recession mostly full-time?

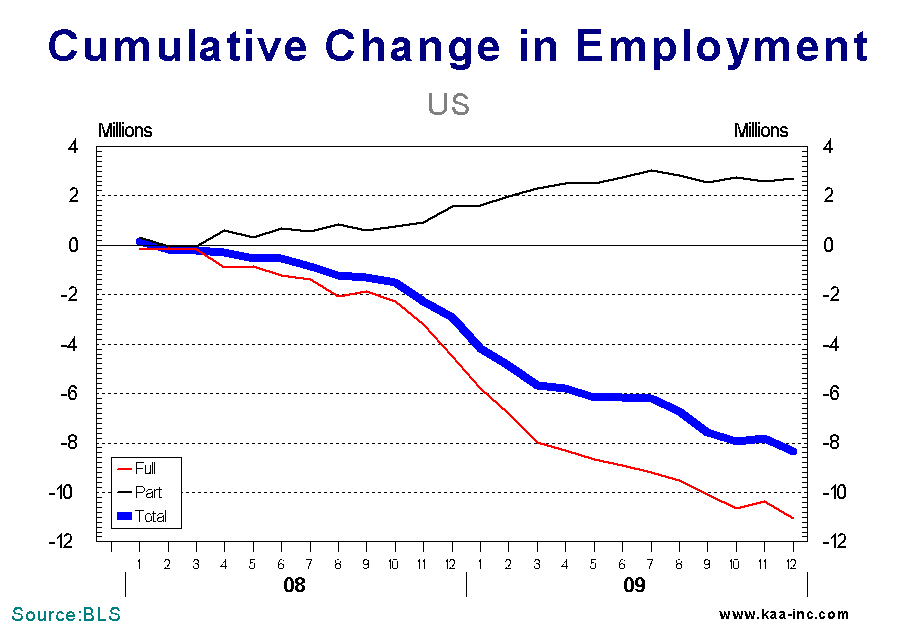

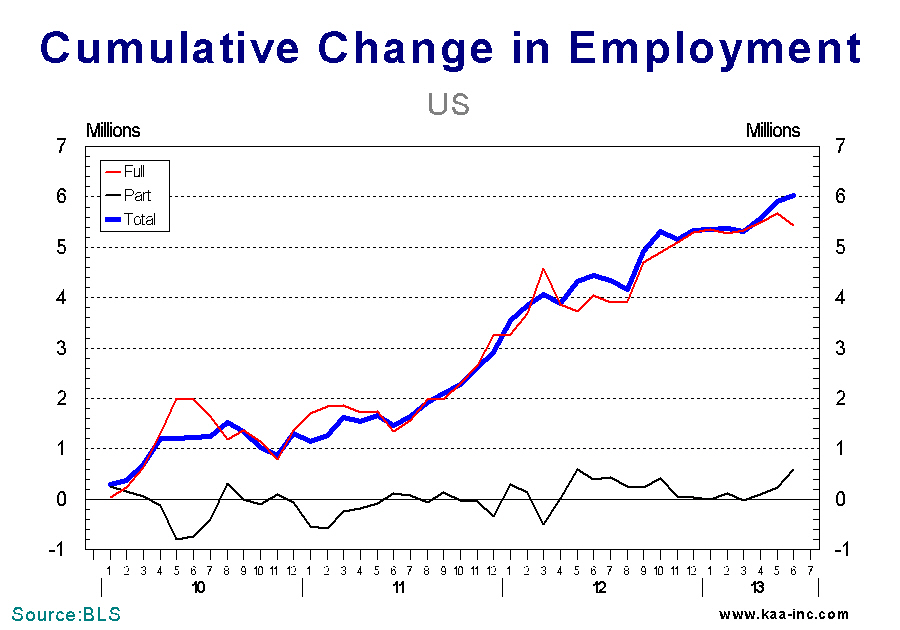

Close to 6 million jobs were created since the employment recovery started in 2010. There are always questions as to what percent of these jobs are part-time employment? And it we use January 2010 as the base, almost all of new jobs, except for half-a-million are full-time jobs. So, what is the answer? Are almost all of the new jobs full time? To answer this question correctly we have to look at the entire picture.

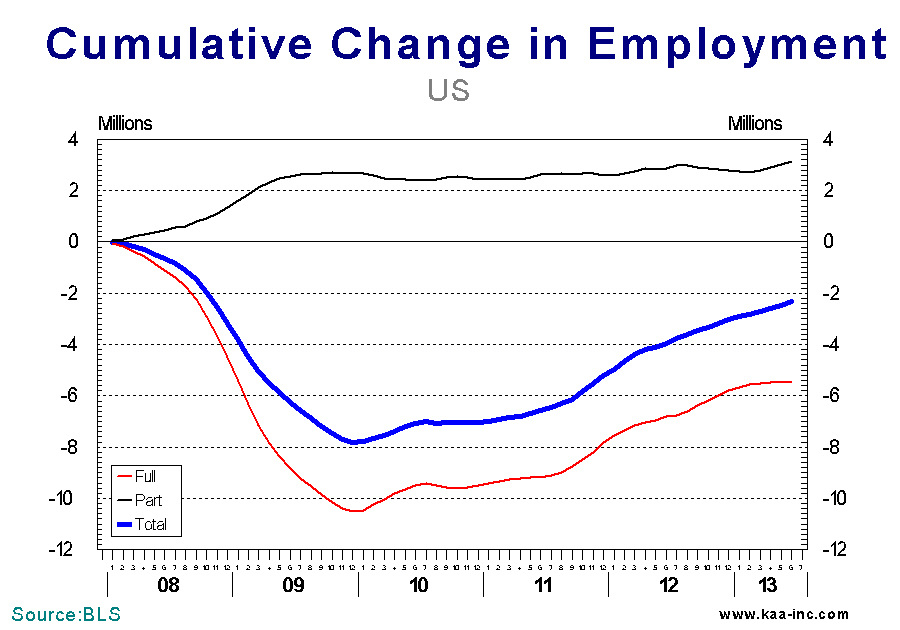

To do so we have to start with January 2008 when blood letting in the job market started. This period lasted through December 2009. During which 11 million full time jobs were lost. Part time jobs, however, moved in the opposite direction, more than 2.7 million part time jobs were created during this period. Clearly some full time jobs were replaced with part time employees. Thus the reported as 8.3 million clearly underestimates the financial devastation that was experienced by American work force.

The job recovery was almost entirely in full time jobs, and it has not been a continuos smooth process; close to 2 million full time jobs were created in the first half of 2010, then a million of them were lost in the second half of the same year. It took the full time job market until mid-2011 before it again showed 2 million jobs gained since the depth of the recession. The number of new jobs grew rapidly to 4 million by winter of 2012. Full time jobs are continuing to add up, however, at a decidedly slower growth rate since then, reaching 5.5 million new full time jobs by June 2013.

Part time jobs, which initially dropped as full time jobs rose, oscillated between half-a-million gain or loss since then.

Total job loss due to the Great Recession was recorded as close to 8 million jobs by the end of 2009. The job recovery has trimmed the total job loss by 6 million, reducing it to around 2 million jobs. During the same period, part time jobs recovered a gain of more 3 million new jobs, almost all of them during the period when full time jobs lost 11 million amongst their ranks.

The brunt of the recession was beared by the full time job holders. Despite the job recovery over the last three-and-a-half years only half of the full time jobs lost has been recovered.

Lehigh Valley’s payroll employment registers well above pre-recession levels and rising

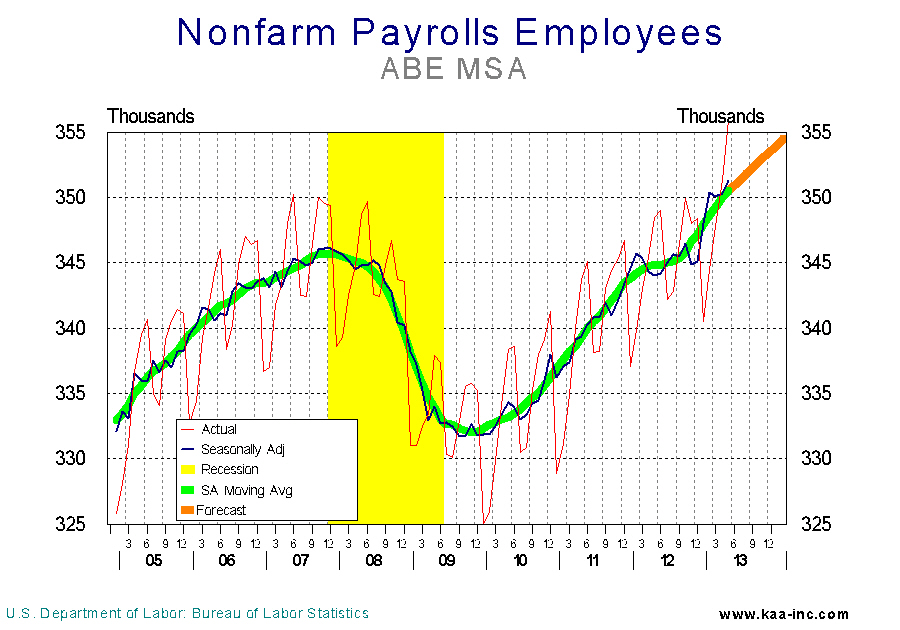

Payroll employment in the ABE MSA reached a high of 346,100 (seasonally adjusted) in December 2007. As the Great Recession took hold, payroll employment in the ABE area dropped to a low of 331,700; a loss of 14,400 jobs.

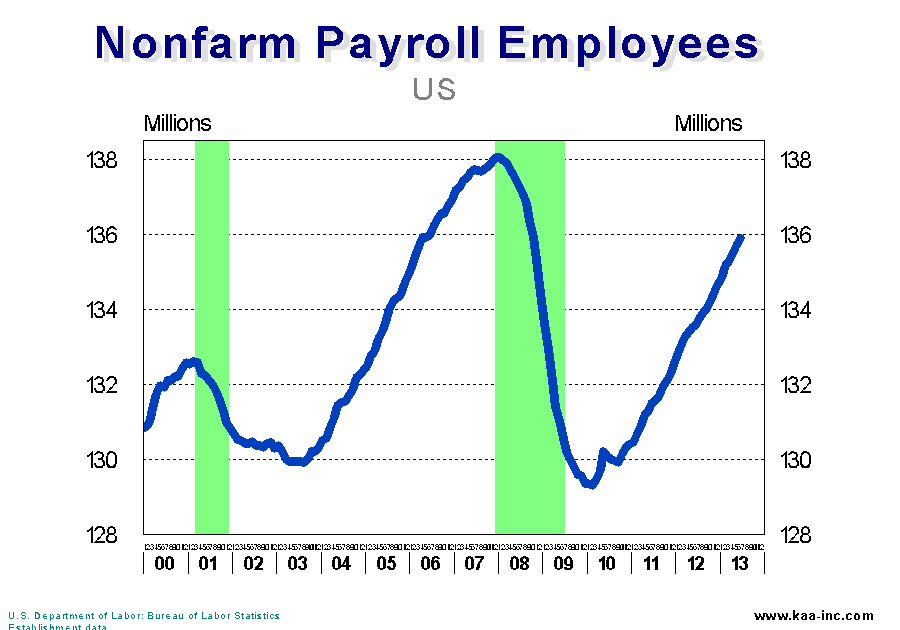

Although the Lehigh Valley lost more than fourteen thousand jobs, it fared better than the national average. Between January 2008 and February 2010, nationwide payroll employment dropped by 6.3 percent, however, in the ABE area it was just 4.2 percent; a little less painful.

The 14,400 jobs that were lost in the region have been recovered, and as of May 2013 an additional 5,200 jobs have been added (a net gain of 1.6 percent). At the national level, 6.3 million jobs have been added (total gain of 4.9 percent), but still 2.4 million short of the high in January 2008. The ABE area, relative to the national average, lost fewer jobs during the Great Recession and has gained more jobs since the start of the recovery.

Why then doesn’t it feel like a recovery? The clear answer is that while the jobs created accounted for those that had been lost it didn’t take into consideration the influx of new graduates and others who were entering the labor force which boosted the total number of job seekers.

When we look at the math; the labor force expanded from 422,900 at the depth of the recession to 439,400 in May 2013, showing an increase of 16,500. To accommodate the 14,400 jobs lost during the Great Recession plus another 16,500 for newcomers to the job market; the creation of at least 30,900 jobs is required. The total gain in new payroll jobs was 19,600; an impressive number. However, when putting it into perspective it is still 11,300 jobs less than where we were in 2007 in terms of the unemployment rate.

A survey of local businesses shows that they are hiring and are planning to hire more people. Absent a major shock to the economy, we project that total employment in the ABE MSA will continue to grow at a better rate than the national average, at least for the balance of this year.

Drop in consumer expenditures and private investment lowered GDP growth

The 1st quarter GDP growth was revised downward from 2.5% to 1.8%. A big chunk of that was due to a downward revision in consumer expenditures from a robust growth of 3.2% to 2.6%. Consumers also appeared to have spent less on “services” than previously estimated, the growth in this category dropped from 3.1% to a relatively poultry 1.7%. The revised consumer expenditures growth of 2.6% is not bad, but it is clearly not robust.

Of more importance to future economic growth, was the significant downward revision of the growth of private domestic investment from 12.3% to 7.4%, while still a good number, it is far from the robust double digits of the original estimate.

There are other minor adjustments to the original estimate, but these two are of most impact and have caused downgrade revisions to most forecasts of 3% plus growth for 2013.

Residential construction waking up from slumber

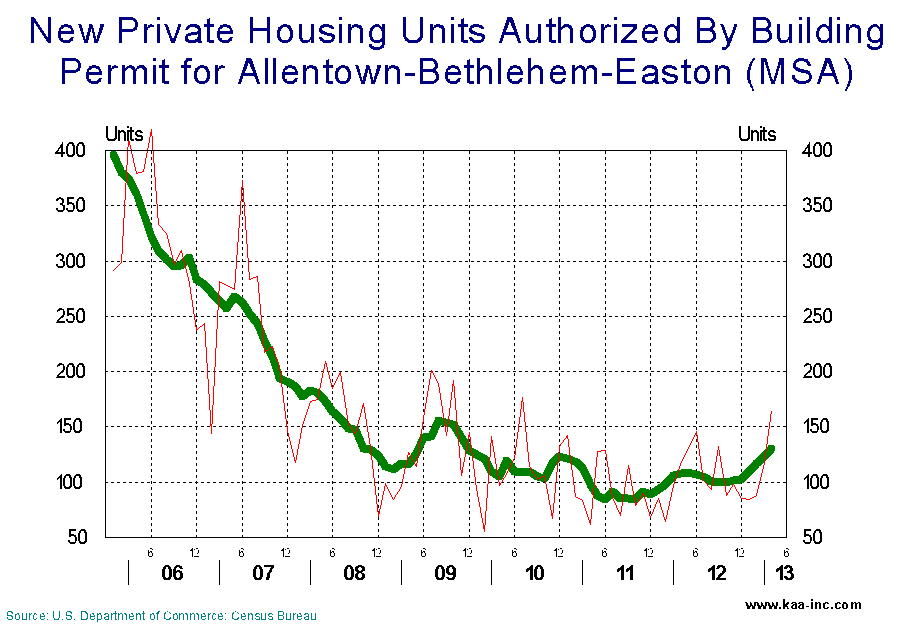

In April 2013 there were 148 (SA) building permits issued for new private housing units in the Allentown-Bethlehem-Easton MSA, which includes Warren, Carbon, Lehigh and Northampton counties. Raising the total number of permits issued in the last 12 months to 1,328. This is 17.5% higher than last April’s level, which is not a huge increase but a positive move in the right direction, keeping in mind that in March 2006 that number was 4,798. permits

Housing starts also followed a similar pattern in the region, it dropped from a high of 4,470 annual starts in 2006, to a low of 942 starts in 2012. This number has improved to 1,065 as of April 2013, an increase of 14.9%.

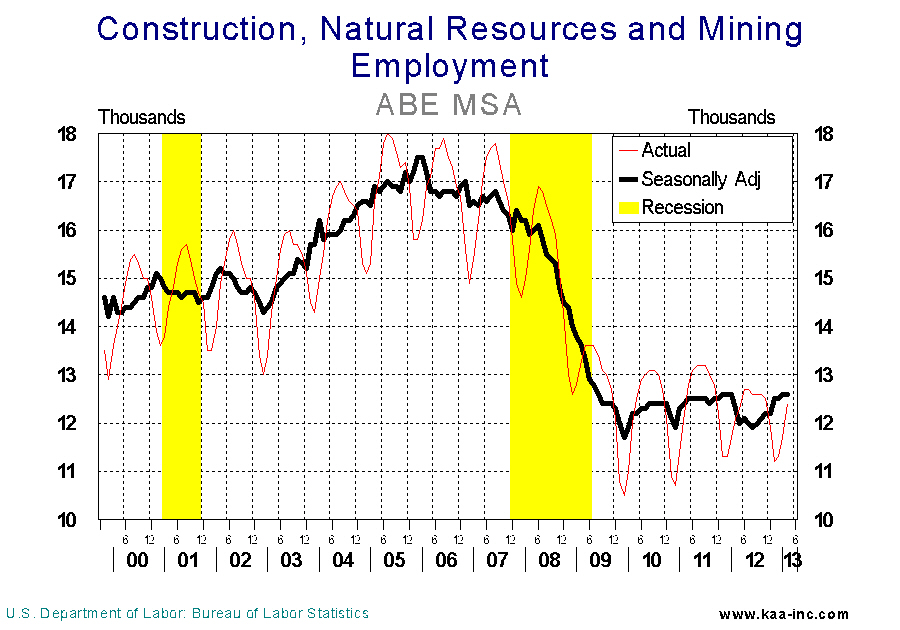

The drop in construction correlates directly with the 42% drop in employment in construction industry between 2005 and 2010. Local construction employment has shown a slight improvement since 2010. While total employment in the region has already exceeded its pre-recessionary level, we are nowhere near recapturing the previous peak employment level in construction. Clearly, construction employment significantly lags the rest of the region.

When all transactions are considered, housing price index has dropped 20% in the ABE MSA from the peak of the housing market, according to the Federal Housing Authority (FHA). The FHA’s price index includes all transactions based on sales price and appraisal data. While housing sales prices in Lehigh and Northampton counties are showing some improvement, the increases are relatively tamed.

Construction employment in the region will continue to improve for the balance of this year with the expectation that it will accelerate in 2014. Reaching the peak level of 2005, realistically, doesn’t appear to be in the cards any time soon.

LV Purchasing & Employment Plans Index

Valley businesses planning to hire 6,600 new employees in the next 6 months.

KAA surveys Lehigh Valley businesses on a quarterly basis and collects around 700 observations per year. The Employment and Purchasing Index for the Lehigh Valley highlights the results of these surveys. In April 2013 we conducted our 54th survey of this series. The following is a summary of our findings.

Business sentiment, as measured by the overall index dropped slightly to 57.6 (seasonally adjusted weighted average, SAWA) in April 2013, a 1.9% decline below its January 2013 level. This index has been oscillating between 57.4 and 59.1 since October 2011. Any index above 50 means more than half of the participants were positive about the economy.

This is not dissimilar to the January survey results whereby participants were significantly more positive about the future than the past.

One of the indicators which has shown some decline is the hiring index which shows the number of people who where hired by the participants in the survey. This index, while still in the positive, has dropped 4.8% below its July 2012 level.

The average participant in the survey had hired 0.4 new employees, which is slightly lower than the post-recessionary average of 0.6 new employees.

Local businesses are planning to increase employment significantly over the next 6 months. The average participant in the survey is planning to add one more employee in the next 6 months. This translates to 6,600 new employees which translates to a 4.2% increase at annual rates. This indicator is at its highest point since 2007.

Both the short and long-term moving averages indicate a sustained trend which began January 2011 and is continuing. The initial increase in employment wasn’t as robust as the planned since January 2011. Between the first quarter of 2011 and the first quarter of 2012, employment in the Lehigh Valley rose by 3,400 jobs, although businesses did plan to hire 7,300 new employees for that period. But that changed, between then and the first quarter of 2013 the Valley’s employment rose by 9,300, very close to what local businesses had planned which was 9,900 new employees. Based on historical data, local employers usually over-estimate how many people they are going to hire, however, with few exceptions like 2011, their plans are generally not that far off the mark.

The index of plans for future hiring has been oscillating between 59.8 and 63.2 since last April. In April 2013 it stood at 61.0 demonstrating an overall positive attitude by employers, however, it is still short of the exuberant positive level which starts at 65.0. It should be noted that the unadjusted indicator stood at 66.8, the highest for this indicator since 2007.

The index of purchasing plans for the next 6 months gave up all its gains for the last 12 months and dropped to 57.8 (SAWA). This index has been going mostly sideways for the last 12 months. However, the average business participating in the survey increased their expenditures plans for the next 6 months from 1.7% in January to 2.8% in April . This number is also more than double the April 2012 level of 1.3%. Indicating that while the number of companies which are planning to increase their expenditures may have not increased significantly, those who were planning to increase their expenditures have upped their plans.

The index of actual expenditures over the last 6 months rose slightly to 57.5 (SAWA) in April 2013. This index also has been oscillating within a narrow band between 56.3 to 60.7 over the last 12 months. Lehigh Valley companies started to increase their expenditures from the middle of 2011 at an increasing rate through July 2012. From then, while increasing expenditures, they were doing it at reduced rates. In January 2013, the average participant in our survey raised their expenditures by zero percent, compared to the previous 6 months. This indicator saw a sharp rebound in April when the average participant raised their expenditure by 1.7% compared to the previous 6 months. We expect to see more increases in this indicator over the balance of 2013.

Between October 2011 and October 2012, planned raises were less than actual increases in expenditures. This was quite disconcerting since the last time we saw such a persistent reversal of normal trends was in July 2007 right before the recession. However, the good news is that for the last two quarters, the order has returned to this indicator and plan increases are again running above actual increase in each quarter.

In the previous issue we referred to businesses changing their assessment of the past and future of the economy in a positive way. We have more evidence that the trend is continuing. While the two indices did not present any difference for a good part of 2012, they have been separating from one another since the end of last year with a better expectation of the future than their assessment of the past. The difference between the two indices started in the 4th quarter of 2012 and is expected to expand; indicating that local businesses believe that the economy’s near future is brighter than its past.

Based on these data it is our expectation that the Valley’s economy will do much better in the next 6 months, especially with a significant increase in employment. We also expect to see local companies continue to increase their purchases at much higher rates than in the past 12 months. Overall, our expectation is for brighter economic situation by summer’s end.

What happened to Inflation?

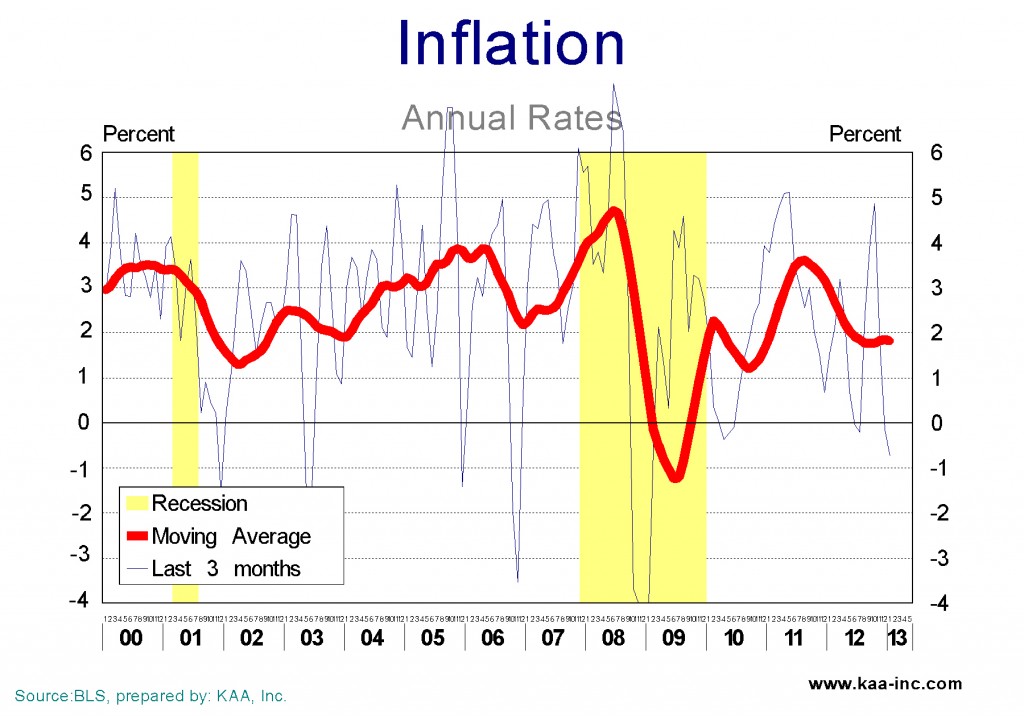

Inflation which was starting to show its ugly face back in 2007-08 was wiped out alongside 8.7 million payroll jobs, the booming housing market, more than 500 commercial banks as well as a large number of other businesses during the Great Recession of 2007-09. The FED also was not all that active during the early months of the Great Recession. The FED eventually discovered in September 2008 that the alarms were for real, and to its credit, it then went to town on raising the money supply. By January 2009 the monetary base was more than doubled. The FED continued to push high powered money into the economy and currently the monetary base is more than 3 times its pre-recession level. Despite pushing all this money into the system, inflation is exceptionally tame. What gives? The Great Recession does. The economy is so badly battered that the velocity of money (the rate of circulation of money in the economy) has crashed, thus while a lot more money is in the economy to go around, since it is circulating a lot slower than it used to, the result is low inflation.

As the recovery gets its running legs back, and employment increases, and businesses start to experience larger and larger sales, the first thing that is going to happen is an increase in the velocity of money. That increase will set a number of alarms off at the FED, if they don’t switch off the alarms again, they will start to pump money out of the economy as fast as they can. Their tool for doing this is selling some of the bonds and papers they have been hoarding in the last four years. This will increase interest rates. Tighter monetary policy is a certainty, the only questions are when are they going to start and how hard are they going to apply the brakes.

Lehigh Valley Payroll Employment Rose Above its Pre-recessionary Highs

Local payroll employment reached a seasonally adjusted volume of 348.4 thousand in February 2013, which is already above the pre-recessionary high of 346.0 thousand recorded in October 2007. While at the national level, average payroll employment is still lagging behind its pre-recessionary highs.

The Lehigh Valley fared better than the average region in the country. Nationwide total non-farm payroll employment dropped by 6.3 percent between January 2008 and February 2010. In the Valley the drop was 4.0 percent, a significantly smaller number.

In the twelve months after hitting bottom, national payroll was up by 1.0 percent, during that same period the Valley’s payroll recorded 1.5 percent growth.

During the following two years of the recovery the increase in the Valley’s payroll employment mirrored the national level with an average annual rate of 1.7 percent. However, due to a smaller contraction at the onset of the Great Recession and slightly stronger growth in the first year of the recovery, the Valley’s payroll employment exceeded its pre-recessionary high by 2,400 jobs or 0.7 percent. At the national level payroll employment still lags behind its pre-recessionary high by 2.7 million jobs or 2.1 percent.

In comparison to the national average, the Lehigh Valley exhibited greater economic strength both during the Great Recession and the first year of recovery. However, and particularly during the last year, the Valley lost its edge and is now growing at a slightly lower rate than the national average.

Businesses more optimistic about the future

KAA surveys Lehigh Valley businesses on a quarterly basis and collects around 700 observations per year. The Employment and Purchasing Index for the Lehigh Valley highlights the results of these suveys. In January 2013 we conducted our 53rd survey of this series. The following is a summary of our findings./p>

Business sentiment, as measured by the overall index rose to 58.8 in January 2013, a 2.7% increase over its October 2012 level. This index has been oscillating between 57.6 and 59.3 since October 2011.

The interesting thing in this data is more about the difference between businesses assessment of the past with their expectations of the future. While the two indices were crisscrossing since October 2011, They started to go their separate ways since October 2012, when the future index ended up 3.6% above the past index. The difference was significantly expanded in January when the future index rose by 12.8% above that of the past. This is the highest relative positive expectation about the future since January 2011 when the future index was 16.0% higher than the past. That was also the end of the upward trend in business sentiment that started in July 2009.

Local businesses plans for future hiring rose to 63.4 in January an increase of 4.8% above its October 2012 level. However, the largest increase in January belongs to plans for future purchases which leaped above its October observation by 8.9%. This index is now at its second highest level since before the Great Recession in October 2007.

Based on these data it is our expectations that, short of another dragged out political battle in Washington, business sentiment in the Valley will rise in the coming months, and with that will come more hiring and increased purchases. While “happy times” are not here again, they are not as far away as they were 3 months ago.

Local businesses show strength on the actual expenditure and hiring; but not so sure when it comes to future plans

KAA surveys Lehigh Valley businesses on a quarterly basis and collects around 700 observations per year. The Employment and Purchasing Index for the Lehigh Valley highlights the results of these surveys. In July 2012 we conducted our 51st survey of this series.

The following is a summary of our findings The Overall Index of Purchasing and Employment Plans for the Lehigh Valley which showed a slight drop in April 2012, recorded a slight growth in July 2012. The July business sentiment index is not statistically different from its January or April 2012 levels. However, it is 7.7% above its July 2011 level. Last year, we observed local businesses becoming more optimistic in the 1st quarter, just to see this enthusiasm erode during the 2nd and the 3rd quarters. This year, we have again observed a significant increase in optimism in January. However, unlike last year, April and July’s data are not dropping, and if anything, the July index is indicative of resumption of growth.

While local businesses are not showing much improvement in their optimism about the future of the economy, their optimism about the last six months has been improving, to the extent that now the two indices are statistically equal. This is unusual since historically future’s index was significantly higher than the past index.

Disappointment with the slow economic growth is making businesses overly cautious. However, the data clearly indicates that despite all of this, businesses are planning to spend more and hire more employees in the next six months.